print-service-dv.ru Gainers & Losers

Gainers & Losers

Hope Finance

Welcome to First Hope Bank, your trusted financial partner. Discover personalized banking solutions and exceptional service for all your financial needs. Hope is a district municipality at the confluence of the Fraser and Coquihalla rivers in the province of British Columbia, Canada. The scholarship provides money to assist students with a portion of the tuition cost at a HOPE Scholarship eligible college or university. Our programs, delivered by Financial Wellbeing Coaches, are here to EDUCATE you on what you need to know, COACH you through putting what you learn into. Cindy Clark has been with the City of Hope since July 1, Mrs. Clark's office is in City Hall. Exploring new leverage frontiers with $HOPE $DREAM $WISH and unique referral system Launch - - 2pm UTC! Discord: print-service-dv.ru We help individuals of all ages by offering financial education, one-on-one coaching, courses on credit score improvement, as well as pathways toward. Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Company Insights: HOPE. HOPE does not have Company Insights. Research. Our right-sized finance program gives students the rigorous curriculum and experiences they need to excel in the marketplace. Welcome to First Hope Bank, your trusted financial partner. Discover personalized banking solutions and exceptional service for all your financial needs. Hope is a district municipality at the confluence of the Fraser and Coquihalla rivers in the province of British Columbia, Canada. The scholarship provides money to assist students with a portion of the tuition cost at a HOPE Scholarship eligible college or university. Our programs, delivered by Financial Wellbeing Coaches, are here to EDUCATE you on what you need to know, COACH you through putting what you learn into. Cindy Clark has been with the City of Hope since July 1, Mrs. Clark's office is in City Hall. Exploring new leverage frontiers with $HOPE $DREAM $WISH and unique referral system Launch - - 2pm UTC! Discord: print-service-dv.ru We help individuals of all ages by offering financial education, one-on-one coaching, courses on credit score improvement, as well as pathways toward. Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Company Insights: HOPE. HOPE does not have Company Insights. Research. Our right-sized finance program gives students the rigorous curriculum and experiences they need to excel in the marketplace.

Hope Financial Services | followers on LinkedIn. One Step Solution For All Your Financial Needs | One Step Solution For All Your Financial Needs. We're committed to helping you make a Hope College education affordable. You are unique, and so is our approach. We review each applicant as an individual. Entity Synopsis Building Hope, a Charter School Facilities Fund established in , is a national nonprofit organization that believes investments in the. The nationally recognized Helping Outstanding Pupils Educationally (HOPE) scholarship program has helped more than million students. Helping Outstanding Pupils Educationally (HOPE) has provided more than $14 billion of financial assistance for educational programs beyond high school. Mixed-Finance public housing allows HUD to mix public, private, and non-profit funds to develop and operate housing developments. New developments may be made. Hope Financial Services | followers on LinkedIn. One Step Solution For All Your Financial Needs | One Step Solution For All Your Financial Needs. Hope-Full, showcasing the extraordinary achievements, enhancements and strides we're making as a lender in the ever-changing bridging finance space. The New Hope Group has built an inclusive rural finance system based around poultry and livestock farming and integrating social capital, government resources. Expert financing solutions for charter school facilities. Our finance team works with impact-minded investors to help schools spend less on fees and interest. Hope Bancorp, Inc. operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals. The HOPE and Zell Miller Grants provide financial assistance for college that does not have to be paid back. HOPE & Zell Miller Grants. Exploring new leverage frontiers with $HOPE $DREAM $WISH and unique referral system Launch - - 2pm UTC! Discord: print-service-dv.ru Envision Financial is a credit union that offers a one-stop shop for all your financial needs. Start with a free chequing account and watch your savings. Hope Air is Canada's only national charity offering free travel & accommodations for Canadians in financial need who must access medical care far from home. The goal of the budget to provide quality service while maintaining property taxes at a reasonable and affordable level. You can visit our Financial Reports. The HOPE Scholarship is funded by the Georgia Lottery for Education and is available to degree-seeking undergraduate students who meet the definition of a. Development Finance. Development around the flow of public and private Hope Policy Institute is the policy division of HOPE (Hope Enterprise Corporation and. The New Hope Group has built an inclusive rural finance system based around poultry and livestock farming and integrating social capital, government resources. Hope-Full, showcasing the extraordinary achievements, enhancements and strides we're making as a lender in the ever-changing bridging finance space.

Best Trading Strategy Books

The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham (); Market Wizards: Interviews with Top Traders by Jack D. Schwager . Best Day Trading Books For Beginners. A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today. Here are some highly recommended trading books for beginners: 1. **"A Random Walk Down Wall Street" by Burton G. Malkiel** - Covers a broad. The best books to help you optimize your trading edge · Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude · The Way of. Building Winning Algorithmic Trading Systems · Python for Finance · Machine Learning for Algorithmic Trading · Algorithmic Trading: Winning Strategies · Advances in. The best-selling investing "bible" offers new information, new insights, and new perspectives. The Little Book of Common Sense Investing is the classic. Technical Analysis Strategies for Beginners · How to Use a Moving Average to Buy Stocks · How to Use Volume to Improve Your Trading · The Anatomy of Trading. The 40 Best Trading Books You Should Read ; Trading book review_systematic trading_robert carver · Systematic Trading ; Trading book review_market beaters_art. Market Wizards written by Jack Schwager is one of the best trading books in the industry. This book interviews numerous successful traders, with interviews from. The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham (); Market Wizards: Interviews with Top Traders by Jack D. Schwager . Best Day Trading Books For Beginners. A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today. Here are some highly recommended trading books for beginners: 1. **"A Random Walk Down Wall Street" by Burton G. Malkiel** - Covers a broad. The best books to help you optimize your trading edge · Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude · The Way of. Building Winning Algorithmic Trading Systems · Python for Finance · Machine Learning for Algorithmic Trading · Algorithmic Trading: Winning Strategies · Advances in. The best-selling investing "bible" offers new information, new insights, and new perspectives. The Little Book of Common Sense Investing is the classic. Technical Analysis Strategies for Beginners · How to Use a Moving Average to Buy Stocks · How to Use Volume to Improve Your Trading · The Anatomy of Trading. The 40 Best Trading Books You Should Read ; Trading book review_systematic trading_robert carver · Systematic Trading ; Trading book review_market beaters_art. Market Wizards written by Jack Schwager is one of the best trading books in the industry. This book interviews numerous successful traders, with interviews from.

The Man Who Solved the Market – Gregory Zuckerman This book may be of interest to traders who like to (or want to) automate their trading strategies. It is. The Best Trading Books Ever Written! · #1 – Market Wizards · #2 – One Good Trade · #3 – New Trader, Rich Trader · #4 – Trading In The Zone · #5 – New Market Wizards. Popular Day Trading Books: How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology. What are the best price action trading books? Trading PA Trends by Al Brooks. Martin Pring on Price Patterns are popular ones to read. We have listed six trading books worth considering: “The Education Of A Speculator” by Victor Niederhoffer, “The Way Of The Turtle” by Curtis Faith, “How I. Forex trading books a comprehensive guide · 1. Currency Trading For Dummies · 2. Forex For Ambitious Beginners · 3. The Black Book Of Forex Trading · 4. How. DEVELOP YOUR FOREX STRATEGY. Check in for regular updates to our suite of technical and fundamental analysis strategies. Build your strategy. Option Volatility and Pricing The best-selling Option Volatility & Pricing has made Sheldon Natenberg a widely recognized authority in the option industry. At. 1. Trading Price Action Series by Al Brooks · 2. Forex Price Action Scalping by Bob Volman · 3. Martin Pring on Price Patterns · 4. Japanese Candlestick Charting. One Good Trade: Inside the Highly Competitive World of Proprietary Trading Mike Bellafiore · Best Loser Wins: Why Normal Thinking Never Wins the Trading Game –. Interactive Day Trading: Ultimate Trading Guide by Satish Gaire · Day Trading for Dummies by Ann C. Logue · The Simple Strategy: A Powerful Day. Mastering the Trade by John Carter Details: This book equips the reader with in-depth strategies and a range of tools. From identifying investment trends to. Recommended Books for Any Trader · The Intelligent Investor · Devil Take The Hindmost · Stock Market Wizards · Manias, Panics & Crashes · The Alchemy of Finance · The. Discover the top 10 trading books of all time, then select a title to find out more about the book and why it was chosen. · Market Wizards · When Genius Failed. Identifying the 'best' trading book of all time is subjective, but many traders and experts often refer to "Reminiscences of a Stock Operator" by Edwin Lefèvre. 1. Beginner's Guide to Day Trading Online by Toni Turner · 2. How to Day Trade for a Living by Andrew Aziz · 3. Mastering the Trade by John Carter · 4. How to Day. Best Day Trading Books · 8. Trading for a Living: Psychology, Trading Tactics, Money Management · 7. Think and Grow Rich · 6. Trading in the Zone: Master the. 1) Quantitative Trading by Ernest Chan - This is one of my favourite finance books. Dr. Chan provides a great overview of the process of setting up a "retail". Trading for a Living by Alexander Elder is a comprehensive guide for anyone looking to make a living from trading in the financial markets. It covers everything. Best Easy To Read Technical Analysis Book · Best Overall Technical Analysis Book · Best Market Profile Book · Best Trading Psychology Book · All Time Classic.

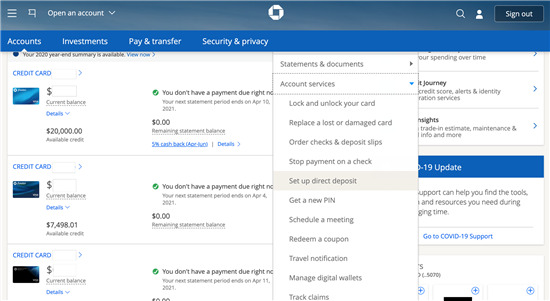

How To Set Up A Direct Deposit With Chase

Go to a Chase Bank branch, if you have an account with them simply request a cashier's check in the amount desired, if you have sufficient funds. Quick steps to complete and design Direct deposit authorization form chase online: · Use Get Form or simply click on the template preview to open it in the. What do you need to set up Direct Deposit? · Your name · Your full address · The correct Chase routing number · Your employer's name and address · Your employee. Swipe up and tap "Set up direct deposit form" Check that the info is correct or make updates, then tap "Create form" Download, print or email the form. Individuals who want to set up direct deposit for their salary or benefits into their Chase checking account may need to provide a voided check to their. Designed for your peace of mind ; Credit score gauge icon. Build your credit ; Deposit check icon. Early Direct Deposit ; Protection shield icon. Zero Liability. Complete this form, then print it, sign it and take it to your employer's payroll department to request direct deposit of your paycheck. Customer name. Address. So I normally get paid on Wednesdays and I switched from Wells Fargo to chase about 3 weeks ago. But my paycheck isn't showing up in chase. Am I. When setting up direct deposit with your employer, you complete a form to select exactly where you'd like your check deposited. It may be possible to split your. Go to a Chase Bank branch, if you have an account with them simply request a cashier's check in the amount desired, if you have sufficient funds. Quick steps to complete and design Direct deposit authorization form chase online: · Use Get Form or simply click on the template preview to open it in the. What do you need to set up Direct Deposit? · Your name · Your full address · The correct Chase routing number · Your employer's name and address · Your employee. Swipe up and tap "Set up direct deposit form" Check that the info is correct or make updates, then tap "Create form" Download, print or email the form. Individuals who want to set up direct deposit for their salary or benefits into their Chase checking account may need to provide a voided check to their. Designed for your peace of mind ; Credit score gauge icon. Build your credit ; Deposit check icon. Early Direct Deposit ; Protection shield icon. Zero Liability. Complete this form, then print it, sign it and take it to your employer's payroll department to request direct deposit of your paycheck. Customer name. Address. So I normally get paid on Wednesdays and I switched from Wells Fargo to chase about 3 weeks ago. But my paycheck isn't showing up in chase. Am I. When setting up direct deposit with your employer, you complete a form to select exactly where you'd like your check deposited. It may be possible to split your.

Set up direct deposit and have your paycheck or other recurring deposits sent right to your checking or savings account — automatically. DIRECT DEPOSIT SET-UP/ BANK SUPPORTING DOCUMENTATION / PHONE APP. CHASE BANK. • On bank app, choose which account you wish to access (checking, savings, etc. direct deposit payroll needs. Step. 1. From the “Send Payments” tab, select CHASE COMMERCIAL ONLINE | BASIC PAyROLL | MAKE A PAyMENt. Select one or. up bonus and easy ways to waive the monthly fee. Select reviews the Chase Total Checking Account, which offers a welcome bonus when you set up direct deposit. You must set up direct deposit to your account. The timing of when these transactions will be credited is based on when the payer submits the information to us. Morgan securities llc. Or any of its affiliates. Chase bank provides a simple and convenient way for clients who want to set up direct deposit. Insurance. Setting up direct deposit for employees – step by step · Choose a direct deposit provider · Complete setup paperwork · Gather employee information · Upload employee. So I normally get paid on Wednesdays and I switched from Wells Fargo to chase about 3 weeks ago. But my paycheck isn't showing up in chase. Am I. Use your Found account and routing numbers to set up direct deposit. You can find both of these from Settings, located at the top left of the screen. How to Set Up Direct Deposit From PayPal to Chase · Sign in your PayPal account to display the My Account page. · Move your cursor to "Profile" and choose ". This service can potentially make direct deposited funds available in your account up to two business days earlier than usual. Banks that offer early direct. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking account 1 and make direct deposits totaling $ or more within 90 days of. Link your external accounts to make payments or transfers. Start of dropdown menuFinding account & routing numbers · Direct deposit · Lock and unlock your debit. You cannot set up deposit for a chase debit card. However, you are able to set up direct deposit for your Chase Bank account and your Chase. I have the acct where I either pay 5$ a month for up to 2 day early deposit or I make ACH deposit of $ or more per month to waive the fee. If you wish to set up or transfer direct deposit of income from investments You can find your account and routing numbers when you sign in to print-service-dv.ru Our ACH and Real-time payment services provide a secure and convenient way to pay your vendors – and your employees – through Direct Deposit. Chase: Total Checking + Savings – $ · Open both accounts with the coupon code. · Receive a direct deposit into the Chase Total Checking® account. · Deposit at. Claim your deposits: Write a check on the account. Make a deposit or withdrawal/payment to the account. Schedule an automatic direct deposit or withdrawal/. Direct Debits and your Chase account To set up a Direct Debit, you'll just need to contact the company you want to pay. They'll ask you to complete a Direct.

How Much Will I Be Pre Approved For A House

What is a mortgage pre-approval exactly? · I'm new to Canada – can I still get pre-approved? · When should I get pre-approved? · How long does it usually take to. Mortgage pre-approval can show sellers you're a serious and credible buyer. Speak to a lender who can help you get pre-approved for a home loan in minutes. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Get pre-approved. Advertising disclosure. Compare current rates in Los Angeles Use this tool to calculate the maximum monthly mortgage payment you'd qualify. However, a 28/36 qualifying ratio is what's likely to get you the best rates. With this ratio, no more than 28% of your income should be going to housing. The other half of a pre-approval is your qualification for the loan. Oftentimes large banks will only issue a rate hold as described above without looking at. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. The lender will also look at the borrower's credit score. If you are pre-approved, the lender will give you a pre-approval letter that states how much of a loan. (We've been in our house for nearly a year so our interest rate is much lower than what they currently are so take that into consideration too.). What is a mortgage pre-approval exactly? · I'm new to Canada – can I still get pre-approved? · When should I get pre-approved? · How long does it usually take to. Mortgage pre-approval can show sellers you're a serious and credible buyer. Speak to a lender who can help you get pre-approved for a home loan in minutes. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Get pre-approved. Advertising disclosure. Compare current rates in Los Angeles Use this tool to calculate the maximum monthly mortgage payment you'd qualify. However, a 28/36 qualifying ratio is what's likely to get you the best rates. With this ratio, no more than 28% of your income should be going to housing. The other half of a pre-approval is your qualification for the loan. Oftentimes large banks will only issue a rate hold as described above without looking at. Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. The lender will also look at the borrower's credit score. If you are pre-approved, the lender will give you a pre-approval letter that states how much of a loan. (We've been in our house for nearly a year so our interest rate is much lower than what they currently are so take that into consideration too.).

Mortgage pre-approval is an examination of a home buyer's finances and lenders require five items to ensure borrowers will repay their loan. On average, it takes days to get a pre-approval, although in some cases it may take less time. To speed up the home loan pre-approval time, you should. Apply now to get pre-approved or request a call from one of our Mortgage Advisors. How much mortgage can I afford? Mortgage tools and calculators · Fixed. Getting pre-approved for a home loan is a best practice to help you determine how much you can borrow before placing an offer on a new home. How much home can you afford? Use our calculator to find out. Then see how much you're preapproved for. Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan. To get a mortgage prequalification, your mortgage lender will review your income, debt and assets, then give you a prequalification letter. This letter is a. How much house can you afford? Enter your details We suggest that all buyers get pre-qualified or pre-approved prior to starting their new home search. Get mortgage pre-qualification in less than 60 seconds. Our pre-approval calculator shows how much you are eligible from banks such as TD, Scotiabank & more. The lender won't take a close look at a borrower's financial situation and history to determine how much mortgage they can reasonably afford until they reach. Based on your information, the lender will give you a tentative assessment as to how much they'd be willing to lend you toward a home purchase. Pre-. A lender will consider how much of your total income will be spent on housing, to decide what you can comfortably afford. If your house payment represents a. In a pre-approved mortgage process, the lender will base its decision upon your income and credit score. As a general rule, your housing costs, including your. Get an edge with sellers and guarantee your interest rate for 90 days with a mortgage pre-approval—it's free and there's no obligation to buy. Get pre-approved. With this ratio, no more than 28% of your income should be going to housing expenses, and your total monthly debt payments (including the new mortgage) should. Mortgage pre-approval is an examination of a home buyer's finances and lenders require five items to ensure borrowers will repay their loan. Getting pre-approved for a loan can help you find out how much you're qualified to borrow. But remember that when it comes to affordability, the amount a. You'll Know How Much You Can Borrow and Afford Getting pre-approved gives you a solid understanding of what you can afford, what you'll be able to borrow, and. For these reasons, many people wait to get a preapproval letter until they are ready to begin shopping seriously for a home. However, getting preapproved early. How much house can you afford? Enter your details We suggest that all buyers get pre-qualified or pre-approved prior to starting their new home search.

Key Man Insurance Companies

Key person life insurance offers a death benefit that can help cover financial losses that occur at the death of a key person. This helps assure continuity of. A key person life insurance policy helps protect the business by having a cash reserve set aside in the event of a company's top talent passes away. Key person insurance is a risk management tool private equity firms and businesses use to alleviate any financial strain caused by the untimely incapacitation. To put it simply, key person insurance is a standard life insurance or trauma insurance policy that is used for business succession or business protection. However, only 22 percent of respondents had key person life insurance in place. What Is Key Employee Insurance? Life or disability income insurance can. Key person policies only cover the death or disability of the individual. If that person leaves the company voluntarily, you'll need to cancel the policy. You. Key person insurance is when a company purchases a life insurance or disability insurance policy on a key employee or owner. Insurance companies typically base the amount of key person insurance needed on a multiple of five to seven times the employee's current salary compensation. Key person life insurance can help protect your business from tragedy. Find out what the purpose of key person insurance is and how it works. Key person life insurance offers a death benefit that can help cover financial losses that occur at the death of a key person. This helps assure continuity of. A key person life insurance policy helps protect the business by having a cash reserve set aside in the event of a company's top talent passes away. Key person insurance is a risk management tool private equity firms and businesses use to alleviate any financial strain caused by the untimely incapacitation. To put it simply, key person insurance is a standard life insurance or trauma insurance policy that is used for business succession or business protection. However, only 22 percent of respondents had key person life insurance in place. What Is Key Employee Insurance? Life or disability income insurance can. Key person policies only cover the death or disability of the individual. If that person leaves the company voluntarily, you'll need to cancel the policy. You. Key person insurance is when a company purchases a life insurance or disability insurance policy on a key employee or owner. Insurance companies typically base the amount of key person insurance needed on a multiple of five to seven times the employee's current salary compensation. Key person life insurance can help protect your business from tragedy. Find out what the purpose of key person insurance is and how it works.

A key man or key woman insurance policy is a life policy taken out on a key employee in a business. The policy is used to protect the company from financial. Even if you intend to close your business after the death of a key person, obtaining key person insurance is still necessary. The money you receive from your. Also known as “key man insurance,” “key executive insurance,” or “corporate owned life insurance” (COLI), this coverage is essentially a life insurance policy. Key Person Life Insurance. Key Person Insurance is a life insurance policy that a company purchases on a key executive's life. The company is the beneficiary of. Key person insurance policies are generally owned by a company and covers key employees who are responsible for the majority of profits. Determining the need for key person life insurance · Technical expertise · Unique skills or training · Reputation and leadership ability · Decision-making. key person life insurance is essentially life insurance that a company purchases to ease the financial strain felt after the death of an owner, partner, or top. Have you heard of key person insurance? Key person insurance adds extra protection to business-essential team members. Learn about key person life insurance. Average 20 year term rates on a $, policy for a key man, 40 to 65 years old. Insured, $, . 6 Best Key Person Insurance Companies · Best Overall: Lincoln Financial · Best for Small Businesses: AIG Direct · Best for Disability Coverage: Guardian · Best. Keyman disability insurance is a risk management strategy designed specifically for the threat of a short-term loss of a key person due to a disabling accident. Key person insurance is purchased by a business to insure the life of one of the company's most vital employees. It's intended to help the company recover from. If the insured key person dies, your business receives the death benefit income tax free, which can be used to help your company recover. Easily transferrable. Therefore, key person insurance is a form of corporate-owned, or company-owned, life insurance (COLI). In some instances, however, the business may split the. Key Person Protection is a life insurance policy (with critical illness cover if selected) taken out to cover the life of a key person within your business. Key person insurance is a type of life insurance policy designed to pay a business upon the death of the insured, as opposed to that person's beneficiaries. With key person insurance, your business is the owner and beneficiary of a life insurance policy for each key employee chosen, which can include business owners. In the event of a death or disability to a mentioned key employee, the company then has the funds to make appropriate business changes to stay in business. It. Like term life insurance, this policy provides capital to help the company move on without that specific person. Investors might worry about the financial. 6 Best Key Person Insurance Companies · Best Overall: Lincoln Financial · Best for Small Businesses: AIG Direct · Best for Disability Coverage: Guardian · Best.