print-service-dv.ru News

News

How To Calculate Pmi For Mortgage

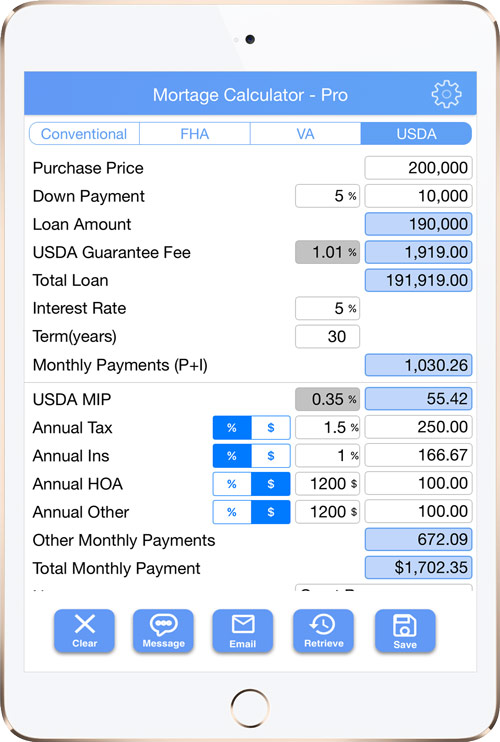

The LTV ratio is calculated by taking the amount of money you borrowed on the loan and dividing it by the value of your property. For more information about canceling your PMI, contact your mortgage servicer. You can calculate your LTOV by dividing your current unpaid principal balance by. Our PMI calculator can help you calculate your monthly mortgage payment with PMI. It can also help you come up with an amortization schedule for your mortgage. Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home. PMI costs can vary from about % to 2% of the loan balance per year. So, for example, on a $, mortgage, the PMI would range from $ to $6, How. Your PMI premium appears in your loan estimate and closing disclosure document. It may also be a line item in your monthly mortgage statement. How to avoid PMI. PMI is calculated as a percentage of your original loan amount and can range from % to % depending on your down payment and credit score. Once you reach. First, ask your lender about your PMI percentage and then multiply the total amount of the loan by this percentage to estimate your premium. If you're paying up. Use this calculator to determine your total monthly mortgage payment including and estimated amount for Private Mortgage Insurance (PMI). The LTV ratio is calculated by taking the amount of money you borrowed on the loan and dividing it by the value of your property. For more information about canceling your PMI, contact your mortgage servicer. You can calculate your LTOV by dividing your current unpaid principal balance by. Our PMI calculator can help you calculate your monthly mortgage payment with PMI. It can also help you come up with an amortization schedule for your mortgage. Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home. PMI costs can vary from about % to 2% of the loan balance per year. So, for example, on a $, mortgage, the PMI would range from $ to $6, How. Your PMI premium appears in your loan estimate and closing disclosure document. It may also be a line item in your monthly mortgage statement. How to avoid PMI. PMI is calculated as a percentage of your original loan amount and can range from % to % depending on your down payment and credit score. Once you reach. First, ask your lender about your PMI percentage and then multiply the total amount of the loan by this percentage to estimate your premium. If you're paying up. Use this calculator to determine your total monthly mortgage payment including and estimated amount for Private Mortgage Insurance (PMI).

Calculate your mortgage insurance quote with BMO's calculator. Coverage includes life and critical illness insurance and disability and job loss insurance. Monthly PMI. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each. Lenders calculate PMI as a percentage of your mortgage loan amount. In general, PMI rates are typically %-2% of your total loan value and will vary by lender. This ranges from % to % depending on your down payment, home price and loan term. Upfront MIP: You can think of this as the FHA funding fee. % of. How Do I Figure Out How Much PMI Will Pay? Your mortgage lender will determine the PMI rate and multiply the percentage by the loan balance. For example, if the. This simple and easy to use mortgage calculator will show you the amortization schedule and breakdown of your payments made towards your home loan. To calculate your PMI costs, multiply your loan amount by the PMI rate and divide by 12 to get your monthly PMI payment. Example: Let's say you're buying a. Mortgage amount — larger loans have a higher PMI cost. Mortgage type — adjustable-rate loans may have a higher PMI cost than fixed-rate loans because. Unlike most private mortgage insurance (PMI) policies, FHA uses an amortized premium, so insurance costs change along with your loan amount. The calculator. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. The Mortgage Brothers Show. Up to date news, tips, and advice, so you can make real estate decisions with confidence. Our Mortgage Calculator includes key factors like homeowners association fees, property taxes, and private mortgage insurance. This calculator indicates how long it takes before ratios of loan balance to property value allow termination of PMI (mortgage insurance). Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Rates for PMI can range from % to 6% of the original loan amount each year. However, your credit score can greatly impact the PMI rate charged by insurance. While the amount you pay for PMI can vary, you can expect to pay approximately between $30 and $70 per month for every $, borrowed. PMI in action. A. Annual PMI rates for a conventional loan range from % to % of the loan amount. PMI payments average $30 to $70 per month for each $, you borrow. Most people pay PMI in monthly installments. However, it can also be paid in a single premium, upfront. According to mortgage insurer Genworth, a borrower with. PMI primarily protects the lender should the borrower stop making payments on a conventional loan. But what many often forget is it also gives homebuyers the.

Stock Investing Lessons

UNLIMITED access to the INVESTING course, exercises and quizzes. · Download the complete stock market courses content as a PDF eBook for future reference – a. The 7 Best Online Investing Courses · 1. Stock Market From Scratch for Complete Beginners by Udemy · 2. Warrior Starter by Warrior Trading · 3. Ultimate Stock. Complete course with many excellent lessons covering all areas of stock market investing. Go from a beginner or intermediate level investor to an expert at. 1. Management matters more than you think · Low stock ownership relative to compensation which encourages principal-agent problems · Conventional. Empower kids & teens to learn the art of investing through interactive online classes. Courses on stocks, cryptocurrencies, and more. The stock markets work in cycles of greed and fear. When there is greed, people are ready to pay more than what a business is worth. But when fear sets in, then. This note describes the most important learning about investing including some very basic principles and some useful tools. Learn techniques and strategies for growing your investment portfolio from world class instructors, with investing courses offered on Udemy. Stock Market Courses Online. Learn about the stock market for investing and trading. Understand market principles, stock valuation, and trading strategies. UNLIMITED access to the INVESTING course, exercises and quizzes. · Download the complete stock market courses content as a PDF eBook for future reference – a. The 7 Best Online Investing Courses · 1. Stock Market From Scratch for Complete Beginners by Udemy · 2. Warrior Starter by Warrior Trading · 3. Ultimate Stock. Complete course with many excellent lessons covering all areas of stock market investing. Go from a beginner or intermediate level investor to an expert at. 1. Management matters more than you think · Low stock ownership relative to compensation which encourages principal-agent problems · Conventional. Empower kids & teens to learn the art of investing through interactive online classes. Courses on stocks, cryptocurrencies, and more. The stock markets work in cycles of greed and fear. When there is greed, people are ready to pay more than what a business is worth. But when fear sets in, then. This note describes the most important learning about investing including some very basic principles and some useful tools. Learn techniques and strategies for growing your investment portfolio from world class instructors, with investing courses offered on Udemy. Stock Market Courses Online. Learn about the stock market for investing and trading. Understand market principles, stock valuation, and trading strategies.

Sustainable Investing, a course from Harvard Business School (HBS) Online, equips people with the insights, frameworks, and skills to evaluate environmental. Learn the basics of stocks, bonds, and investing so you can be independent and confident about your financial decisions. This class will teach you how to. You will learn how to invest to create wealth in stocks, index funds, real estate, building businesses, and side-hustles. Research Stocks Before You Buy To understand what you're investing in, you need to do your homework. For an individual stock, that could mean looking at the. Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. Our suite of investing lessons is meticulously crafted to provide answers and insights into these areas, offering a holistic view of vital investment concepts. TEACHING STOCKS AND INVESTING Stock Market AND Investing Lessons If you are looking to teach or learn about stocks and investing, you've come to the right. because it is the only factor affecting your investment risk and return that you can control." 4) "Bubbles occur whenever investors begin buying stocks simply. 10 Investing Lessons For Stock Market Beginners · 10 Investing Trends With HUGE Return Potential · 50 Investing Terms YOU SHOULD KNOW (Stock. Book overview The book is filled with informative, straight forward, educational, mini-lessons regarding the world of individual stocks and investing. If you. Over 30 short and concise stock market and investing courses for beginners. Includes a virtual $ in a practice account. Many people have an intuitive understanding of stocks but are at a loss when it comes bonds. Get a grip on this vital investment vehicle by probing the. The Stock Market Investing course provides a deep dive into stock valuation techniques and market analysis, utilizing real-world case studies of companies like. Master stock market investing in small group classes or corporate training in NYC or at your offices. Learn what moves stock prices, how bonds and options. 7 Strategies to Simplify Your Investment Portfolio & Make it Less Stressful · 20 Common Investment Mistakes & How to Avoid Them | Lessons in Investing for. Andy has taught hundreds of thousands of investors and entrepreneurs around the world. His webinar How Anyone Can Start Stock Investing for Cash Flow will give. Master stock market investing in small group classes or corporate training in NYC or at your offices. Learn what moves stock prices, how bonds and options. When most people talk about investing, they're usually referring to investments in stocks, bonds and investment funds, which are all types of securities. If. Investing for Beginners online courses, curated by Coursera ; Financial Markets. Yale University · Rated out of five stars. reviews ; Investment. 1. **Coursera**: "Introduction to Financial Markets" by Yale University. · 2. **edX**: "Stock Market Investing for Beginners" by NYIF. · 3. **.

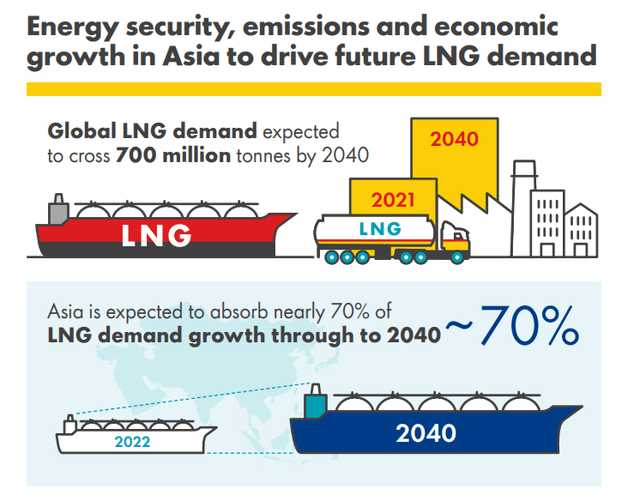

Shell Stock Forecast 2025

Stock Price Target. High, $ Low, $ Average, $ Current Price, $ SHEL will report FY earnings on 01/30/ Yearly Estimates. stock evaluations with Nasdaq Shell PLC American Depositary Shares (each representing two (2) Ordinary Shares) (SHEL) P/E & PEG Ratios. Price/Earnings. The Shell plc stock prediction for is currently $ , assuming that Shell plc shares will continue growing at the average yearly rate as they did in the. x. EV / Sales *, x. Free-Float. %. Yield *. %. Yield Price, Change, Volume. , €, +%, M. , €, +. share buybacks to $ billion between and While rising forecast of $ billion in a survey of analysts provided by Shell. For Shell PLC ADR (SHEL Stock Forecast) price prediction is USD. The price forecast is September 14, Sunday; and USD for Shell stock price stood at $ According to the latest long-term forecast, Shell price will hit $75 by the end of and then $85 by the end of Based on our forecasts, a long-term increase is expected, the "SHEL" stock price prognosis for is USD. With a 5-year investment, the revenue. The average price target is 3,p with a high forecast of 4,p and a low forecast of 2,p. The average price target represents a % change. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ SHEL will report FY earnings on 01/30/ Yearly Estimates. stock evaluations with Nasdaq Shell PLC American Depositary Shares (each representing two (2) Ordinary Shares) (SHEL) P/E & PEG Ratios. Price/Earnings. The Shell plc stock prediction for is currently $ , assuming that Shell plc shares will continue growing at the average yearly rate as they did in the. x. EV / Sales *, x. Free-Float. %. Yield *. %. Yield Price, Change, Volume. , €, +%, M. , €, +. share buybacks to $ billion between and While rising forecast of $ billion in a survey of analysts provided by Shell. For Shell PLC ADR (SHEL Stock Forecast) price prediction is USD. The price forecast is September 14, Sunday; and USD for Shell stock price stood at $ According to the latest long-term forecast, Shell price will hit $75 by the end of and then $85 by the end of Based on our forecasts, a long-term increase is expected, the "SHEL" stock price prognosis for is USD. With a 5-year investment, the revenue. The average price target is 3,p with a high forecast of 4,p and a low forecast of 2,p. The average price target represents a % change.

On average, Wall Street analysts predict that Shell's share price could reach $ by Jul 12, The average Shell stock price prediction forecasts a. The 4 analysts with month price forecasts for Shell stock have an average target of 86, with a low estimate of 79 and a high estimate of Shell PLC has a consensus price target of $ based on the ratings of 8 analysts. The high is $90 issued by Scotiabank on July 12, Shell plc: Forcasts, revenue, earnings, analysts expectations, ratios for Shell plc Stock | SHEL | GB00BP6MXD Q1, Q2, Q3, Q4, Q1. According to analysts, SHEL price target is 3, GBX with a max estimate of 4, GBX and a min estimate of 2, GBX. Check if this forecast comes. Analyst Estimates: More Content: Snapshot, Stock Price Targets, Yearly Numbers, SHEL will report earnings on 01/30/ Shell Plc Adr Stock (SHEL) is expected to reach an average price of $ in , with a high prediction of $ and a low estimate of $ The 16 analysts offering 12 month price targets for Shell PLC have a median target of 3,, with a high estimate of 6, and a low estimate of 2, Shell PLC ADR analyst ratings, historical stock prices, earnings estimates & actuals. SHEL updated stock price target summary SHEL will report FY On average, Wall Street analysts predict that Shell 's share price could reach $ by Jul 19, The average Shell stock price prediction forecasts a. Shell stock prediction for April In the beginning at Maximum , minimum The averaged price At the end of the month dollars. Shell stock price forecast for September The forecast for beginning dollars. Maximum price , minimum Averaged Shell stock price for the. The average one-year price target for Shell plc is € 42, The forecasts range from a low of € 32,99 to a high of € 86, A stock's price target is the. In , Shell PLC reported a dividend of USD, which represents a % increase over last year. The 19 analysts covering the company expect dividends of. Shell Share Price Forecast For , 20 Shell share price forecast for September In the beginning the price at GBp. Maximum What will Shell stock price be worth in five years ()?. The SHELL ("SHELL") future stock price will be EUR. Will SHELL stock price crash? Find the latest Shell plc (SHEL) stock quote, history, news and other vital information to help you with your stock trading and investing. Forecast Earnings Growth · In February , analysts believe the stock price will be £ · Our prediction anticipates that Shell plc stock will go down. Discover all the factors affecting Shell's share price. SHELL is currently rated as a Super Stock | Stockopedia. Tuesday, Feb 4th, Q4 Shell PLC. Shell PLC (SHEL:LSE) forecasts: consensus recommendations, research reports, share price forecasts, dividends, and earning history and estimates.

Pornstars That Do Meetups

Our BIGGEST guest yet: Retired porn star Gina Valentina joined us on The Coffee Breakup. What an epic that you do not want to miss. print-service-dv.ru 'real pornstars meetup' Search, free sex videos. Real Pornstars VR - Sexy blonde babes do whatever they want with your big cock! I like to do food tours and try different places. Lmk if you'd want If you can't find us, just ask the staff for NYC Meetups and they'll point us out. Pre bookings only *emails only please- (Please do not waste my time. You will be blocked. I will not answer questions without a tip or screening and deposit). and filming it all I film with pornstars ⭐️, amateur dudes , my REAL life friends Limited offer - 90% off for 30 days! SV. ✨ 90% VIP SALE ⚠️ DO. up a meeting and have her fulfill my.. The sexy MILF porn star has the kind of ass that I would love to worship, and I'm going to do exactly that tonight. What Does a Pornstar Do? Pornstars are performers who performs sexual acts on camera for the viewing pleasure of viewers. This includes women and men. XVIDEOS fan-meet-up videos, free. Do Battle With Cockzilla! 12 min. 12 minBangbros Network - k Views -. p. PeachyPop Fan Meet Up Porn/Hentai Game 8. porn star it can be very hard to find one. I know the top Japanese actresses do meetups. Do you do those at all? No, I do not and thank goodness. Our BIGGEST guest yet: Retired porn star Gina Valentina joined us on The Coffee Breakup. What an epic that you do not want to miss. print-service-dv.ru 'real pornstars meetup' Search, free sex videos. Real Pornstars VR - Sexy blonde babes do whatever they want with your big cock! I like to do food tours and try different places. Lmk if you'd want If you can't find us, just ask the staff for NYC Meetups and they'll point us out. Pre bookings only *emails only please- (Please do not waste my time. You will be blocked. I will not answer questions without a tip or screening and deposit). and filming it all I film with pornstars ⭐️, amateur dudes , my REAL life friends Limited offer - 90% off for 30 days! SV. ✨ 90% VIP SALE ⚠️ DO. up a meeting and have her fulfill my.. The sexy MILF porn star has the kind of ass that I would love to worship, and I'm going to do exactly that tonight. What Does a Pornstar Do? Pornstars are performers who performs sexual acts on camera for the viewing pleasure of viewers. This includes women and men. XVIDEOS fan-meet-up videos, free. Do Battle With Cockzilla! 12 min. 12 minBangbros Network - k Views -. p. PeachyPop Fan Meet Up Porn/Hentai Game 8. porn star it can be very hard to find one. I know the top Japanese actresses do meetups. Do you do those at all? No, I do not and thank goodness.

TW Pornstars features popular videos, tweets, users, hashtags from Twitter.

@DrippyDaDevil. ·. Oct 6, DrippyDaDevil Would Like This ☺️☺️ Like & ReTweet If You Can Do This print-service-dv.ru This post is unavailable. Do you do meetups?: Why? So you can kill me? Negative! What do you like about your body?: My tiny round ass. Why are you here?: I love showing off my tiny. The Saved Posts are never stored on your device, and do not leave any trace Lets Meet Up And Have Some FUN!!! REVIEWED Fri. Aug. 1. Girl. Real. do, so your money will be well spent with me. I am % real and I dedicate myself to what I do!!! * I am a host in a safe and discreet location I accept. Why do porn bots follow me? (Or anyone). What's the scam there? The Saved Posts are never stored on your device, and do not leave any ✨️ NO MEETUPS✨️VIDEOCHAT ✨️VIDEOS ✨️NUDES ✨️SEXT ➡ print-service-dv.ru porn star. If you are a male model looking to reach out to females for Do your best to keep up to date on your sexual health! Negotiating How The. We're familiar with the way they fuck and suck. What you don't get to see is what they do on their own time. Day With a Porn-star will show you everything, from. We did all the hard work for you and compiled a huge list of pornstars on Facebook so you won't have to manually search for each and every single pornstar. this week. Reid deserves credit for walking into the lion's den after we dueled on X. We discussed political differences in a civil way, which is hard to do. Halle Still Doing Meetups Pornstar Meetups Pornstars: Karmen Karma Halle Still Doing Meetups. Added: 1 year ago. 44 views. 93%. Albums for. do not screen any Users or Advertisers of the Websites, has no control over their actions and makes no representations or warranties with respect to the. DEE WILLIAMS IN DO ME JESSE! What can I say about getting some action from Jesse Dubai. I have gotten a lot of dick but by far Jesse has one of the most. The best Pornstars Meet Fans porn videos are right here at YouPorn Fan meetup XXX style - Zaria nova petite pierced up. p. Fan. 10 Meetups Around Kayleigh Wanless Pornstar You Should Attend > 자유게시판 | 심리센터 心유(심유) - 심리상담, 심리검사, 기업심리 | 개인상담, 종합심리검사. After all, a pornstar makes a living having sex on camera. Think of what he or she can do in bed! The reality is that dating a pornstar isn't that much. Pornstars Who Only Fans Know Lana Cruise is a big-name pornstar with a huge following. The blonde slut appears regularly on top sites such as Adult Time. I bet you do, so keep on reading! In this article we will share all the hot girls in the adult film industry who have launched their own official Telegram chat. Gay Porn · Shemale Porn · All tags · Channels · Pornstars · RED videos · Live Cams + · Games · Dating · Profiles · Liked videos · My subs · History; Version.

Do I Report Cryptocurrency On Taxes

According to IRS Notice –21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D and Form • Report crypto in your tax return. • Report capital gains, losses You must report 'disposals' of crypto for capital gains tax purposes if you. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. Selling cryptocurrency held as a capital asset for legal tender, for another virtual currency, or exchanging it for a service constitute barter transactions. Yes, the IRS requires that you report cryptocurrency rewards or earnings even if you don't receive a Form MISC or Form NEC. Companies ar. Cryptocurrency itself is not taxed. Rather, transactions involving cryptocurrency are considered taxable events, at least at the federal level in the United. Crypto losses must be reported on Form ; you can use the losses to offset your capital gains—a strategy known as tax-loss harvesting—or deduct up to $3, Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form The IRS requires a summary statement for any investment that wasn't reported on a Form B. You may use your crypto Form as your summary statement. According to IRS Notice –21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D and Form • Report crypto in your tax return. • Report capital gains, losses You must report 'disposals' of crypto for capital gains tax purposes if you. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. Selling cryptocurrency held as a capital asset for legal tender, for another virtual currency, or exchanging it for a service constitute barter transactions. Yes, the IRS requires that you report cryptocurrency rewards or earnings even if you don't receive a Form MISC or Form NEC. Companies ar. Cryptocurrency itself is not taxed. Rather, transactions involving cryptocurrency are considered taxable events, at least at the federal level in the United. Crypto losses must be reported on Form ; you can use the losses to offset your capital gains—a strategy known as tax-loss harvesting—or deduct up to $3, Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form The IRS requires a summary statement for any investment that wasn't reported on a Form B. You may use your crypto Form as your summary statement.

For example, if you buy $1, of crypto and sell it later for $1,, you would need to report and pay taxes on the profit of $ If you dispose of. When answered “Yes,” the IRS would look for a Form filed by the taxpayer to report capital gain/loss for virtual currency transactions. How do I file my. In short, crypto swap losses must be reported on your taxes. So long as the crypto swap loss is realized (realized and unrealized crypto swap losses will be. There are no special tax rules for cryptocurrencies or crypto-assets. Reporting tax evasion (shadow economy activity) · Drug and tobacco smuggling. Currently for the US, only if you sold or traded/swapped crypto you will need to file capital gains/loses. Digital Asset Received as Compensation. If an employee is paid with digital assets, the employee must report the value of assets received as wages. The employer. If you substantially understated your income by not reporting the crypto, the IRS may assess an accuracy-related penalty of 20% of the unreported tax. Generally. How Do Cryptocurrency Taxes Work? Because cryptocurrencies are viewed as assets by the IRS, they trigger tax events when used as payment or cashed in. When. These must be reported on your tax return. Gains are taxed, while losses can offset other gains and up to 3,$ of other income. Blockpit's free crypto. However, it does mean that the cryptocurrency may have an obligation to report the transaction to the IRS, and it also means that all cryptocurrency. Are crypto to crypto trades taxed? Yes. Any exchange of cryptocurrencies is also a taxable event. For ex. if you exchange Bitcoin for Ripple, the IRS and other. No sale, no tax? Not so fast. If you received crypto as income, you do need to report it as income, even if you didn't sell it. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. Cryptocurrency itself is not taxed. Rather, transactions involving cryptocurrency are considered taxable events, at least at the federal level in the United. Any time you make or lose money on your investments, including cryptocurrency, you need to report it on your taxes using Schedule D. Ever since If you earned more than $ in crypto, we're required to report your transactions to the IRS as “miscellaneous income,” using Form MISC — and so are you. If you used cryptocurrency to send or transfer money as a gift, then these transactions may need to be reported on a gift tax return (Form ). Additionally. The IRS requires a summary statement for any investment that wasn't reported on a Form B. You may use your crypto Form as your summary statement. Even if you are just a consumer using your coins to make purchases, this should be reported on your tax return. Even trading one cryptocurrency for another is. In the IRS' view, because there is not a de minimis exemption for other types of property, absent instructions from Congress, there should not be one for.

Hand Sanitizer In Hospitals

Beyond the question of choosing hand sanitizer vs. hand-washing, proper hand hygiene overall is essential to maintaining the health of patients in the hospital. Soap and water are preferable to hand sanitizer if the hands are visibly soiled or dirty. Hospitals; Urgent Care/Walk-In. Choose a location, Mount Sinai. Hospital Epidemiology and Infection Control. Guidelines for Hand Sanitizer Dispenser Locations. 5/7/ I. Fire Marshal Requirements. 1. See electrical. There are no studies that indicate the significance of hand hygiene compliance (HHC) by hospital visitors, although both the World Health Organization and the. • Antiseptic hand wash: Washing hands with water and soap or other hospital are compatible with sanitizer. Page HEALTHCARE-ASSOCIATED. Waterless hand sanitizer formulated to promote skin health and reduce the spread of infections. Contains moisturizers to condition and protect the skin. Studies show that consistent hand hygiene is the most important and least expensive way to reduce healthcare-associated infections (HAIs) and the spread of. Hand hygiene is an important aspect of patient safety. Patients should expect everyone who enters their room to clean their hands. Before any hospital staff. PURELL® hand sanitizers are designed to be easy to use and are highly effective against germs. With our clinically proven performance and trusted brand name. Beyond the question of choosing hand sanitizer vs. hand-washing, proper hand hygiene overall is essential to maintaining the health of patients in the hospital. Soap and water are preferable to hand sanitizer if the hands are visibly soiled or dirty. Hospitals; Urgent Care/Walk-In. Choose a location, Mount Sinai. Hospital Epidemiology and Infection Control. Guidelines for Hand Sanitizer Dispenser Locations. 5/7/ I. Fire Marshal Requirements. 1. See electrical. There are no studies that indicate the significance of hand hygiene compliance (HHC) by hospital visitors, although both the World Health Organization and the. • Antiseptic hand wash: Washing hands with water and soap or other hospital are compatible with sanitizer. Page HEALTHCARE-ASSOCIATED. Waterless hand sanitizer formulated to promote skin health and reduce the spread of infections. Contains moisturizers to condition and protect the skin. Studies show that consistent hand hygiene is the most important and least expensive way to reduce healthcare-associated infections (HAIs) and the spread of. Hand hygiene is an important aspect of patient safety. Patients should expect everyone who enters their room to clean their hands. Before any hospital staff. PURELL® hand sanitizers are designed to be easy to use and are highly effective against germs. With our clinically proven performance and trusted brand name.

Production of tons per month, first delivery on March 24 · Pharmacies and hospitals to receive the hand sanitizers free of charge · In cooperation with Olin. Outside of the hospital, most people catch respiratory viruses from direct contact with people who already have them, and hand sanitizers won't do anything in. Massachusetts General Hospital requires all physicians, nurses and other staff/volunteers to clean their hands with Cal Stat, an alcohol-based hand rub. For Patients & Their Families · Hospital Performance Report · How Well Is Your If you don't have soap and water, use an alcohol-based hand sanitizer that. Good hand hygiene—washing hands or using a hand sanitizing gel—is the number one way to prevent the spread of germs. Health care workers should wash their. We require our staff to clean their hands both before and after taking care of a patient. We also remind our patients and visitors to clean their hands often to. Many studies show that hand sanitizers work well in clinical settings like hospitals, where hands come into contact with germs but generally are not heavily. (Remember: alcohol-based hand rubs not effective against spore-forming bacteria as C. Difficile.) Using an alcohol-based hand sanitizer: Apply 1 pump of product. An attractive, versatile line of wall dispensers for use with Avant hand sanitizers and Aterra hand soap refills that can be easily mounted anywhere. CenTrak's RTLS hand hygiene compliance solution captures all hand hygiene events with a best-in-class tracking system, giving hospitals the tools they need to. Get premium hand sanitizers for hospitals plus antiseptic bottles at American Hospital Supply. Protect yourself, staff, and family from infectious germs. Hand sanitizer (also known as · hand antiseptic, · hand disinfectant, · hand rub, or · handrub) is a liquid, gel, or foam used to kill viruses, bacteria, and other. The Centers for Disease Control and Prevention (CDC) guidelines state that if hands are dry after 15 seconds, an insufficient volume of product was likely. Alcohol hand sanitizers are alcohol-based liquid, gel, rub, or foam hand cleaners. They don't require water to clean hands and kill most germs that cause. Our soaps and hand sanitizers are formulated to meet the stringent requirements of hospitals, ensuring optimal cleanliness and protection against nosocomial. Before and after visiting someone in hospital. Hand Sanitiser (alcohol hand rub). Hand sanitiser (alcohol gel) is more effective than soap and water provided. Previously the standard called for hospitals to demonstrate hand hygiene compliance at a rate greater than 90 percent. A hospital that failed to comply would. Hand hygiene refers to cleaning hands by handwashing with soap and water or using an alcohol- based hand sanitizer (antiseptic hand rub including foam or gel). Production of tons per month, first delivery on March 24 · Pharmacies and hospitals to receive the hand sanitizers free of charge · In cooperation with Olin. Clean your hands · Remove jewellery · Wet hands under running water · Apply soap and rub together, covering all surfaces of both hands for at least 15 seconds.

Best Affordable Small Towns To Retire

What are some good places for an American to retire if they prefer a small town setting with good weather, low taxes, and a low cost of. Cost of living: 5% above the national average · Median home price: $, · Median monthly rent: $1, · Metro population: , · State taxes: No state income. 15 Best Small Towns To Retire on $2, a Month · Cumberland, Kentucky · Crossett, Arkansas · Corning, Arkansas · Ozona, Texas · Medicine Lodge. Forbes and MoneyWise have once described Wenatchee as one of the nation's top places to retire. Wenatchee, as well as the greater Wenatchee Valley area, is. 15 Best Small Towns To Retire on $2, a Month · Cumberland, Kentucky · Crossett, Arkansas · Corning, Arkansas · Ozona, Texas · Medicine Lodge. 8 Most Affordable Places to Retire in the U.S. · Download Now: 15 Free Retirement Planning Checklists [Complete Kit] · Williamsburg, Virginia · Jacksonville. Lawrence, Kansas Home to the University of Kansas, Lawrence is a quintessential college town with arts, culture, sports and plenty of open, green spaces. It's. We've found 25 places that love retirees. We've listed how much the average home cost is as well as whether the state is tax-friendly toward retirees. These affordable small towns to retire in Georgia promise comfort, a laid-back atmosphere, and a safe destination that golden agers can call home. What are some good places for an American to retire if they prefer a small town setting with good weather, low taxes, and a low cost of. Cost of living: 5% above the national average · Median home price: $, · Median monthly rent: $1, · Metro population: , · State taxes: No state income. 15 Best Small Towns To Retire on $2, a Month · Cumberland, Kentucky · Crossett, Arkansas · Corning, Arkansas · Ozona, Texas · Medicine Lodge. Forbes and MoneyWise have once described Wenatchee as one of the nation's top places to retire. Wenatchee, as well as the greater Wenatchee Valley area, is. 15 Best Small Towns To Retire on $2, a Month · Cumberland, Kentucky · Crossett, Arkansas · Corning, Arkansas · Ozona, Texas · Medicine Lodge. 8 Most Affordable Places to Retire in the U.S. · Download Now: 15 Free Retirement Planning Checklists [Complete Kit] · Williamsburg, Virginia · Jacksonville. Lawrence, Kansas Home to the University of Kansas, Lawrence is a quintessential college town with arts, culture, sports and plenty of open, green spaces. It's. We've found 25 places that love retirees. We've listed how much the average home cost is as well as whether the state is tax-friendly toward retirees. These affordable small towns to retire in Georgia promise comfort, a laid-back atmosphere, and a safe destination that golden agers can call home.

If you're looking for the cheapest place in Texas to live, another consideration is Killeen. Nearby Fort Hood has one of the largest military bases in the U.S. The Villages: Known as a haven for retirees, The Villages offers more than just a place to live; it provides a lifestyle. With its own town squares, golf. 1. Decatur, Alabama. Cost of living for retirees: % below U.S. average · 2. Prescott, Arizona · 3. Hot Springs, Arkansas · 4. Grand Junction, Colorado · 5. For retirees looking to live in a big city on a small budget, Des Moines is a good choice. Affordability is just one reason the Milken Institute ranked the. Consider some of the many Florida communities that boast affordability and access to the retirement lifestyle you are dreaming of. Here are 25 budget-friendly. Lawrence, Kansas Home to the University of Kansas, Lawrence is a quintessential college town with arts, culture, sports and plenty of open, green spaces. It's. If you prefer a small town beach retirement, Astoria might be the right fit. This coastal city, which is located on the Columbia River (close to the Pacific. If living expenses are the most important factor for retirement, a recent analysis says these are the best places to live. 35 Affordable Waterfront Retirement Towns: Best U.S. Towns for an Affordable Retirement Along a Lake, River or Seacoast (Best Places to Retire) [Kelley. Tucson: With its affordable cost of living, rich cultural heritage, and diverse culinary scene, Tucson appeals to retirees seeking a more laid-back lifestyle. 5 Best Places to Retire in Colorado on a Budget · 1. Eaton · 2. Canon City · 3. Grand Junction · 4. La Veta · 5. Commerce City. Which is the best state to retire in and low cost? It depends on the These are the Most Expensive Places to Retire in the U.S.. Premium Investing. Here Are the 11 Best Places to Retire on a Budget · 1. St. George, Utah · 2. Palm Coast, Florida · 3. Loveland, Colorado · 4. Cape Coral, Florida · 5. Surprise. Why Is Tennessee A Good State For Retirees? · Affordable housing and cost of living · The tax rates are favorable · The mild climate · Tennessee has a beautiful. Where do you retire for a slice of the good life? Winterville. Located minutes east of Raleigh and an hour from the water, this town of under 10, ideally. great place to live, but which towns are the best options for retirees affordable waterfront living opportunities perfectly suited to a retiree's budget. Orlando, FL, is the best place to retire, living up to its reputation as a haven for seniors. One big reason for this is the lack of taxes, as Orlando is one of. Palm Coast is a popular destination for retirement due to its beautiful weather, affordable cost of living, and range of recreational activities. Palm Coast is. Set in Jefferson County, Port Townsend is another one of the many affordable places to retire in Washington State. It's also a great town for seniors looking to. First on our list: Wenatchee. Topping both MoneyWise's list of inexpensive places to retire and Forbes' list of the best places to retire in the West, Wenatchee.

Not Being Approved For Credit Cards

Designed for consumers with bad or no credit, “guaranteed approval” credit cards don't check your credit history when deciding whether to approve or deny you. Regions does not control which MCC a merchant is assigned; it is based on the primary good or service the merchant sells. If a merchant's MCC does not match the. Being denied for a credit card doesn't hurt your credit score. But the hard inquiry from submitting an application can cause your score to decrease. up costing you more than you think. And even if you are pre-approved, you still have to apply and get approved, and so you may end up not qualifying for the. credit approval. Learn More & Apply. Must apply here for this offer card and anonymous prepaid card transactions or transactions not processed by Visa. These credit checks are considered “soft inquiries,” and they will not impact your credit scores. Once you decide to apply for a pre-approved offer, however. While there's no guarantee you're going to be approved for a credit card, going into the process with knowledge about which factors will be considered and how. Sometimes, a credit card company will freeze or cancel your card out of the blue if they detect potentially fraudulent activity or suspect that your account. What are the three main reasons credit card applications are denied? · 1. Your credit report may have incorrect information · 2. Capacity to service the debt · 3. Designed for consumers with bad or no credit, “guaranteed approval” credit cards don't check your credit history when deciding whether to approve or deny you. Regions does not control which MCC a merchant is assigned; it is based on the primary good or service the merchant sells. If a merchant's MCC does not match the. Being denied for a credit card doesn't hurt your credit score. But the hard inquiry from submitting an application can cause your score to decrease. up costing you more than you think. And even if you are pre-approved, you still have to apply and get approved, and so you may end up not qualifying for the. credit approval. Learn More & Apply. Must apply here for this offer card and anonymous prepaid card transactions or transactions not processed by Visa. These credit checks are considered “soft inquiries,” and they will not impact your credit scores. Once you decide to apply for a pre-approved offer, however. While there's no guarantee you're going to be approved for a credit card, going into the process with knowledge about which factors will be considered and how. Sometimes, a credit card company will freeze or cancel your card out of the blue if they detect potentially fraudulent activity or suspect that your account. What are the three main reasons credit card applications are denied? · 1. Your credit report may have incorrect information · 2. Capacity to service the debt · 3.

Not all transactions are considered to be Purchases and eligible to earn rewards, such as transactions posting as Convenience Checks; Balance Transfers. Build up your credit profile. Go to your bank and see if you can get a credit card there. They will look at your work history and salary history. Credit Cards for No Credit · Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER. See if you're approved with no impact to your credit score. 3. Turn Your Cart Into Unlimited Cash Back. Your application will be rejected if you do not meet the income requirements specified by the lender. Occupation. Occupation is another important factor. There is no impact to your credit score when you check for matched offers. If you apply, get approved, and then choose to accept a Card, your credit score may. To be eligible for bonus offers, you must not have opened the same credit If your credit card application is approved, you will be provided with a link. Usually, a computer algorithm is denying your application and not a real person, so don't take it too personally. For this reason alone, getting a credit card. OpenSky Secured Visa: The OpenSky Secured Visa is a no credit check card that's also a secured credit card. · First Progress Platinum Elite Secured Mastercard. Credit Cards for No Credit · Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER. Short Answer: Yes, if the card is still not officially approved, you may be able to contact the credit card issuer to cancel before you are officially. You can apply for a no-credit-check secured card, which as the name implies does not report your application as an inquiry to the major credit bureaus. But with. Usually, a computer algorithm is denying your application and not a real person, so don't take it too personally. For this reason alone, getting a credit card. Fast, flexible, secure. No matter which Card you're approved for, if eligible, American Express gives you the option to add your actual Card. If you are not approved for a new account, you will receive a written Your credit card must be confirmed; if it is not confirmed, no money will transfer to. Capital One Platinum Secured Credit Card. Capital One Platinum Secured Credit Card · No annual or hidden fees. See if you're approved in seconds ; PREMIER. The length of your credit history is an important aspect of your credit score and getting new credit. You can build credit by opening an account in your name. Discount will be given as a barcode that can be redeemed for any single total purchase and does not have to be applied same day as approval. 2Offer is exclusive. View questions about: · Your application has been approved · Your application has been approved, but for a different card offer · We need more time to review your. You will see a temporary drop in your credit score after you apply for a credit card. This applies whether or not you are approved for the card. Opening a new.

Amateur Day Trading

This tutorial will give you a thorough break down of day trading strategies for beginners, working all the way up to advanced, automated and even asset-. What differentiates professional day traders using profit targets per trade and amateur day traders is how they come up with the profit target to set for each. The answer, simply, is yes. Day trading is profitable. How long does it take to become profitable? That seems to vary. The term "day trading" has evolved to include not just professional traders but also amateur traders who consider it their primary occupation. Day traders. Day Trading Podcasts · 1. Top Dog Trading · 2. Anarchy: Day Trading for Rebels · 3. Mindset Of A Day trader · 4. Day Trading Forex with Jerrell Coleman · 5. The. In this guide to day trading for beginners, we'll help you understand more about what day trading entails. But amateur day traders are almost never in a position to have better information than other market participants, and in most cases the opposite is true. In. But amateur day traders are almost never in a position to have better information than other market participants, and in most cases the opposite is true. In. Some common types of day trading strategies that you may want to research include technical analysis, scalping, momentum, swing trading, margin and so on. This tutorial will give you a thorough break down of day trading strategies for beginners, working all the way up to advanced, automated and even asset-. What differentiates professional day traders using profit targets per trade and amateur day traders is how they come up with the profit target to set for each. The answer, simply, is yes. Day trading is profitable. How long does it take to become profitable? That seems to vary. The term "day trading" has evolved to include not just professional traders but also amateur traders who consider it their primary occupation. Day traders. Day Trading Podcasts · 1. Top Dog Trading · 2. Anarchy: Day Trading for Rebels · 3. Mindset Of A Day trader · 4. Day Trading Forex with Jerrell Coleman · 5. The. In this guide to day trading for beginners, we'll help you understand more about what day trading entails. But amateur day traders are almost never in a position to have better information than other market participants, and in most cases the opposite is true. In. But amateur day traders are almost never in a position to have better information than other market participants, and in most cases the opposite is true. In. Some common types of day trading strategies that you may want to research include technical analysis, scalping, momentum, swing trading, margin and so on.

Day Trade to Win focuses on teaching traders how to use their own computers to successfully trade popular futures and currencies. A survey from the brokerage Charles Schwab revealed that 70% of day traders have established a trading strategy. Around 45% of traders dedicate hours daily. Due to the regular profits the capital that a successful day trader uses for trading increases continuously. At the end of the trading day, all positions are. To start day trading, choose an amount of money to invest and select a trading platform. If you're new to stock markets in general, it may benefit you to work. LIVE DAY TRADING | Trading Premarket and the Open | NYSE - NASDAQ | Day Trading the stock market live: Sign up now for the Traders Launch FREE. Seminars and software alone do not make a successful day trader, cautions author Josh DiPietro. Instead, a trader must learn hard lessons of self-discipline. Day Trading: A Practical Guide with Best Beginners Strategies, Methods, Tools and Tactics to Make a Living, and Create a Passive Income from Home [Robert. The best chart patterns for day trading include the triangle, flag, pennant, wedge, and bullish hammer chart patterns. Top courses in Day Trading and Stock Trading · Stock Market Trading: The Complete Technical Analysis Course · Live Stock Trading Course: Beginner to Pro · Complete. Amateur: The amateur trader believes that after a few winning trades in a row he has acquired superior skills or that his trading strategy is suddenly a money. A well-defined trading strategy is essential for day trading success. This involves identifying entry and exit points, determining position sizing, and. Listen to Day Trading for Beginners on Spotify. Welcome to "Day Trading for Beginners," hosted by Tyler Stokes of print-service-dv.ru A Step by Step Guide to Day Trading Success. StokesTrades is more than a personal diary. It's an evolving guide for fellow beginners. I'll share every step of. Day trading is a grind, requiring participants to spend long hours in front of screens watching the market or studying data. Selecting the right stocks is. This podcast is a real-time chronicle of my journey into the world of day trading, starting from the very basics. print-service-dv.ru is the top international guide to online day trading in We review the best day trading brokers and trading platforms. Sadly, amateur traders don't realize that psychology is the foundation of day trading success. They simply ignore emotional intelligence. While technical. The key for day traders is to find beneficial entry and exit points in the markets that enable them to take small, regular profits from often tiny market. In The Truth About Day Trading Stocks, DiPietro offers the amateur day trader a brutally honest look at the pitfalls of day trading—and how to hopefully avoid.

What Are Long Term Capital Gains Tax Rates

They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. India ; Bonds, Less than 12 months, More than 12 months, Slab rate, 10% without indexation ; Real estate/property, Less than 24 months, More than 24 months, Slab. Short-term capital gains are taxed as ordinary income; long-term capital gains are subject to a tax of 0%, 15%, or 20% (depending on your income). Short-term capital gains (for assets held for less than a year) are typically taxed at your ordinary income tax rate, which can range from 10% to 28%. Long-term capital gains tax rate is 0%, 15%, or 20% depending on the individual's taxable income and filing status. Long-term capital gains tax rates are. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are Alaska. long-term capital gains tax rate by filing status ; Head of Household, Up to $59,, $59, to $,, $, and up ; Married Filing Jointly, Up to. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. India ; Bonds, Less than 12 months, More than 12 months, Slab rate, 10% without indexation ; Real estate/property, Less than 24 months, More than 24 months, Slab. Short-term capital gains are taxed as ordinary income; long-term capital gains are subject to a tax of 0%, 15%, or 20% (depending on your income). Short-term capital gains (for assets held for less than a year) are typically taxed at your ordinary income tax rate, which can range from 10% to 28%. Long-term capital gains tax rate is 0%, 15%, or 20% depending on the individual's taxable income and filing status. Long-term capital gains tax rates are. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are Alaska. long-term capital gains tax rate by filing status ; Head of Household, Up to $59,, $59, to $,, $, and up ; Married Filing Jointly, Up to. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on.

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double. State Capital Gains Tax Rates ; 3, Washington D.C., % ; 5, Oregon *, % ; 6, Minnesota, % ; 7, Massachusetts, %. As of , the long-term capital gains tax is typically either 0%, 15% or 20%, depending upon your tax bracket. This percentage will generally be less than. Long-term capital gains generally qualify for a tax rate of 0%, 15%, or 20%. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. What is capital gains income? What are short- and long-term capital gains? When a taxpayer sells a capital asset, such as stocks, a home, or business assets. They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC The maximum capital gains tax rate for individuals and corporations · – · % · %. Short-term capital gains from the sale or exchange of capital assets. %. For income exceeding $1,,, there is an additional surtax of 4%. Note: For tax. Capital gains are subject to income tax at the rate of 15%. Kenya (Last reviewed 11 July ), 15, Korea, Republic of (Last reviewed 13 June ). Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one year or less must be included in your. Short-Term Capital Gains Taxes for Tax Year (Due April ) ; Single Filers · $0 - $11, · $11, - $47, · $,+ ; Married, Filing Jointly · $0 -. If you have long-term gains, the next thing you need to know is which capital gains tax bracket you fall into – the 0%, 15%, or 20% bracket. Just like with your. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. The maximum long-term capital gains and ordinary income tax rates were equal in through Since , qualified dividends have also been taxed at the. Arizona taxes capital gains as income, and both are taxed at the same rate of %. Arkansas. In Arkansas, 50% of long-term capital gains are treated as income. Single filers with incomes more than $,, will get hit with a 20% long-term capital gains rate. The brackets are a little bigger for married couples filing. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. After , the capital gains tax rates on net capital gain (and qualified dividends) are 0%, 15%, and 20%, depending on the taxpayer's filing status and.