print-service-dv.ru News

News

What Is The Best Home Appliance Warranty Company

With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America. Some common household systems and appliances that are covered by a home warranty: "We have had nothing but great experiences with all of the service providers. Given its solid appliance limits and extensive add-on catalog, we consider Liberty Home Guard (LHG) the top home appliance insurance provider in this review. FREE quote! Shield your wallet from unexpected repair costs with an award-winning protection plan from SHW. Appliance and home warranty coverage for any. Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. Choice is the best home warranty company for thousands of happy policy holders because we listen to our customers. This means we can give them the coverage and. Among the home warranty companies we researched, Liberty Home Guard has the best overall review rating from the Better Business Bureau— stars from more than. Whether you are thinking about purchasing a home warranty plan for your new home or just want to have peace of mind when it comes to your appliances, BBB is. American Residential warranty is the best company offering a home warranty plan with a service fee as low as $55, which is comparatively lowest. With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America. Some common household systems and appliances that are covered by a home warranty: "We have had nothing but great experiences with all of the service providers. Given its solid appliance limits and extensive add-on catalog, we consider Liberty Home Guard (LHG) the top home appliance insurance provider in this review. FREE quote! Shield your wallet from unexpected repair costs with an award-winning protection plan from SHW. Appliance and home warranty coverage for any. Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. Choice is the best home warranty company for thousands of happy policy holders because we listen to our customers. This means we can give them the coverage and. Among the home warranty companies we researched, Liberty Home Guard has the best overall review rating from the Better Business Bureau— stars from more than. Whether you are thinking about purchasing a home warranty plan for your new home or just want to have peace of mind when it comes to your appliances, BBB is. American Residential warranty is the best company offering a home warranty plan with a service fee as low as $55, which is comparatively lowest.

Home Warranty Companies · Liberty Home Guard · Choice Home Warranty · Landmark Home Warranty · American Home Shield · Select Home Warranty. When your home's systems and appliances break down, you'll want the best home warranty company on the case. America's Preferred Home Warranty is here to help. Super Home Warranty offers subscription plans that cover repair and replacement of home appliances and systems, and provides maintenance services for a flat. Best Home Warranty Company - Complete Appliance Protection! Call today - Best Home Warranty Reviews & Home Warranty Plans. Best for high coverage limits: Choice Home Warranty · Best for discounts: AFC Home Warranty · Best for membership benefits: American Home Shield · Best for. Let's look at the main advantages of home warranties. Peace Of Mind. You can relax knowing your home warranty coverage protects your essential appliances and. Protect your home and budget with ARW Home's comprehensive home warranty plans. Get reliable coverage and 24/7 service for all your household needs. home warranties so that you can make the best decision for your situation. A home warranty is a contract between a home protection company (a.k.a. “home. A Progressive home warranty from Cinch helps pay to repair or replace your household appliances and systems. Learn why you need one, how it works, and more. What items does a Home Warranty cover? · Home warranties can have limited coverage, and might exclude kitchen appliances, water heaters, plumbing, furnaces, and. Learn about home warranties and choose the best plan to secure your home and budget from unforeseen home system and appliance repairs with ORHP! American Home Shield (AHS) is a trusted home warranty provider with over 50 years of experience, offering protection for home systems and appliances. AHS has. Fast, free quotes by America's highest rated, most trusted home warranty provider. Get coverage on all of your home's systems and appliances. Home Warranty Reviews - The #1 research site for Home Warranty Companies, Compare home warranty plans, coverage, cost, services, and claims. Home Buyers Warranty offers home warranty plans and coverage to fit your needs and budget. We protect your home systems and appliances. Liberty Home Guard is the best home warranty company due to its extensive list of optional add-ons, competitive pricing and nationwide coverage. Protect your home and budget with comprehensive home warranty plans from Home Warranty Inc. Get fast, reliable coverage for appliances and systems. Get a quote. Purchase home warranty coverage to protect your budget when your critical home systems and appliances break down. Cinch Home Services is a home warranty company serving over 1m customers yearly, with over 45 years of experience of protecting homeowners. See highly-rated professional home warranty companies for free. Read real local reviews If you buy an older home with most or all original appliances, a.

Taking Out Equity On A House

It lets you use the remaining equity in your house to borrow more money, usually up to 80% of the home's value combined. It then repays. Also keep in mind that a home equity loan or line of credit decreases the amount of equity you have in your home. If you have taken out too much equity and the. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. Take a look at these five alternatives to a cash-out refinance to see how they compare and find the solution that best suits your financial needs. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing. take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways. In order to use the equity you would have to borrow money and issue and you would have a new mortgage. This is what is called a refinance. You. To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. It lets you use the remaining equity in your house to borrow more money, usually up to 80% of the home's value combined. It then repays. Also keep in mind that a home equity loan or line of credit decreases the amount of equity you have in your home. If you have taken out too much equity and the. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. Take a look at these five alternatives to a cash-out refinance to see how they compare and find the solution that best suits your financial needs. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing. take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways. In order to use the equity you would have to borrow money and issue and you would have a new mortgage. This is what is called a refinance. You. To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance.

Also keep in mind that a home equity loan or line of credit decreases the amount of equity you have in your home. If you have taken out too much equity and the. If you have substantial equity in your home, a cash-out refinance lets you pay off your current mortgage by refinancing it at a higher amount and taking the. By contrast, a HELOC is Home Equity Line of Credit. Instead of taking out the full amount at once, you have an open credit line you can borrow against during a. You can use a home equity loan or a home equity line of credit (HELOC), to unlock the equity in your house once you've built up enough of it, usually by paying. Adds risk to your finances, potential to lose a home and still owe a debt. You'll be financing at a much higher rate than before probably. Idk. You build equity in your home each time you make a payment toward your mortgage's principal balance. Your equity can also increase if the market value of your. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. Funding for house renovations or upgrades is the primary reason homeowners take out a home equity loan. Such renovations include patio makeovers, garage. Take your home's value, and then subtract all amounts owed on that property. The difference is the amount of equity you have. Visit Citizens to learn more. By taking out a loan that uses your property as collateral, you might be able to convert your equity into money that you can use to provide additional monthly. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. The most common options for tapping the equity in your home are a HELOC, home equity loan or cash-out refinance. Home equity loans and HELOCs have roughly. Can your income support more mortgage repayments? · Homeowners have many different ways of using their home's equity. You can take out a mortgage, refinance, get. take your home as payment for your debt. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways. Whatever amount you borrow, you can use the loan to fund your projects: roof upgrade, new patio deck, interior renovations, etc. Whenever you take out a loan. As a general rule of thumb, lenders offer loans equal to 80% of your home equity. Your credit history, income, and other financial obligations will also factor. Home equity loan interest rates are usually fixed, highly competitive, and can even be close to first mortgage rates. Taking out a home equity loan can be much. Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage(s), including.

What Is The Definition Of Whole Life Insurance

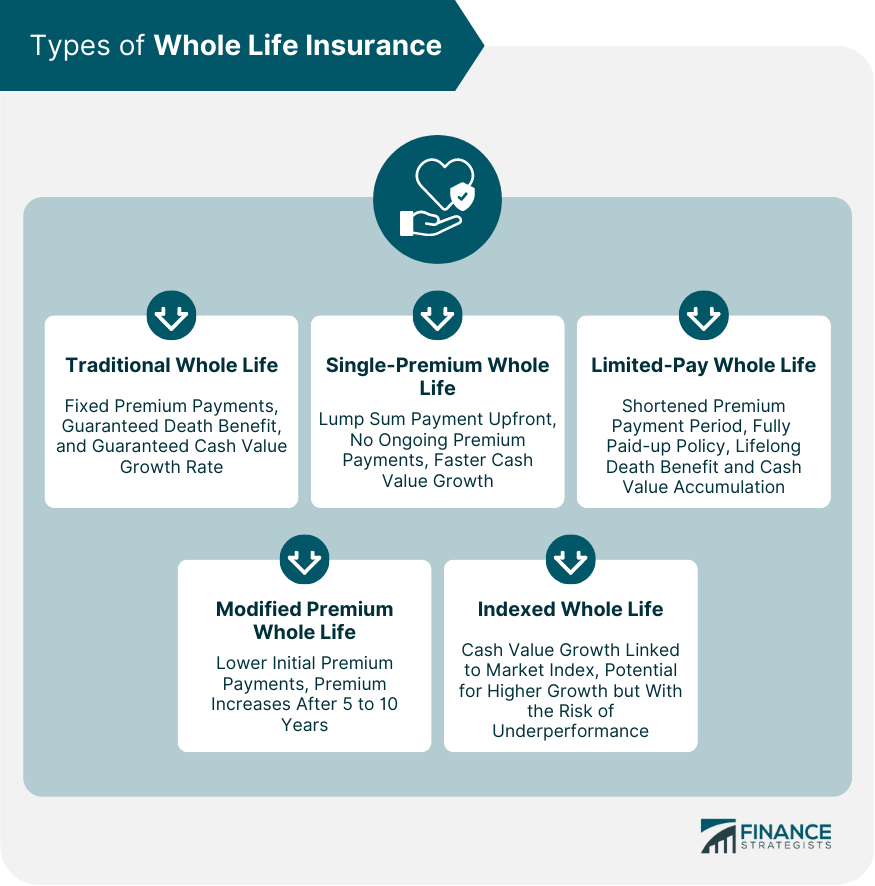

Typically, whole life insurance costs more because it serves as an investment. This investment, otherwise known as the cash value, is able to grow throughout. Like whole life, a universal life insurance policy provides a lifetime of coverage and can build cash value over time. However, this type of policy also gives. Whole life insurance is a permanent insurance policy that pays the beneficiaries a specific amount upon the death of the insured. Whole life insurance is a comprehensive and enduring form of life insurance that provides long-term coverage and financial security throughout an. Whole life insurance policies have a fixed premium, meaning you pay the same amount each and every year for your coverage. Much like universal life insurance. What a whole life insurance policy offers · Guarantees for your family · Accumulation benefit · Tax advantages & dividends · Financial reliability. Whole life insurance is a permanent life plan that provides coverage throughout your entire life. The premiums tend to cost more than a term plan would. Whole life ensures a guaranteed death benefit, which means that your loved ones will receive a lump sum of money regardless of how long you live. Build cash. a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. Typically, whole life insurance costs more because it serves as an investment. This investment, otherwise known as the cash value, is able to grow throughout. Like whole life, a universal life insurance policy provides a lifetime of coverage and can build cash value over time. However, this type of policy also gives. Whole life insurance is a permanent insurance policy that pays the beneficiaries a specific amount upon the death of the insured. Whole life insurance is a comprehensive and enduring form of life insurance that provides long-term coverage and financial security throughout an. Whole life insurance policies have a fixed premium, meaning you pay the same amount each and every year for your coverage. Much like universal life insurance. What a whole life insurance policy offers · Guarantees for your family · Accumulation benefit · Tax advantages & dividends · Financial reliability. Whole life insurance is a permanent life plan that provides coverage throughout your entire life. The premiums tend to cost more than a term plan would. Whole life ensures a guaranteed death benefit, which means that your loved ones will receive a lump sum of money regardless of how long you live. Build cash. a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is a permanent policy that offers lifelong coverage. This means that it will pay out to your loved ones no matter when you pass away. Protect your loved ones with whole life insurance. It's a lifelong policy with premiums that remain the same and it includes living benefits like cash value. used to describe a life insurance agreement with a person in which the insurance company pays money when that person dies. Whole life insurance is a type of permanent life insurance policy that offers the insured a savings module known as the cash value while paying a fixed premium. A whole life policy is the simplest form of permanent life insurance, named because it provides coverage that lasts your entire life as long as premiums are. A whole life insurance policy offers lifelong coverage and a death benefit that your beneficiaries may claim regardless of when you pass away (if you have paid. whole life - A type of insurance policy that remains valid for the insured's lifetime with payments made for a defined period. Whole life is a form of permanent life insurance that lasts as long as you live (assuming you pay the policy's premiums). It also includes a cash value account. Lesson Summary · Single-premium life insurance is a lump sum paid upon death and has a fixed interest rate. · Limited payment life insurance · Variable. Whole Life Insurance Definition Life insurance that provides coverage for the entire life of the policyholder, who pays the same fixed premium throughout his. Whole life insurance is the simplest form of permanent life insurance, with guarantees for the death benefit amount, premium costs, and cash value growth. The meaning of WHOLE LIFE INSURANCE is a type of life insurance that costs the same as long as the insured person is alive and that pays benefits to. Whole life insurance is also referred to as “ordinary life” or “straight life.” It provides coverage for your entire lifetime. The premium depends on your age. The meaning of WHOLE-LIFE is of, relating to, or being life insurance with a fixed premium for the life of the policyholder and a cash value that can be. Your policy builds cash value that is guaranteed to grow over time. Whole life can be a versatile tool to help meet several needs, like assuring (via the death. Sometimes called permanent insurance, a whole life insurance policy provides coverage for your entire life as long as you pay the premiums. This type of. WHOLE LIFE INSURANCE meaning: a type of life insurance that costs the same as long as the insured person is alive and that pays benefits to survivors when. Whole life insurance policies from Bankers Life offer protection by providing level premiums, guaranteed benefits and cash value build up for your lifetime. Enjoy lifelong protection1 and other features you can use throughout your life with this type of permanent life insurance. As you make payments, your policy. Whole life coverage is designed to last—you guessed it—your whole life, as long as you keep paying your bill. When you pass away, your beneficiaries may receive.

Bankrate New Car Loan

Latest Auto Loan Rates from Banks and Credit Unions Across the Country & Compare Current Auto Loan Rates, Read Auto Loan Reviews & Save on Your Car Loan. It may be easier to secure a loan for a new car than it is for a used car, and new car loans often come with lower interest rates. Used cars can be a good. The three main factors in getting the best rate for an auto loan are your credit score, finances and the lender. Get expert advice on auto loans. Compare auto loan rates and discover how to save money on your next auto purchase or refinance. Shopping for a car? If you need a auto loan, find out how much you can borrow, and compare financing options. Calculating your payments is easy! The new car loan interest at IDFC FIRST Bank is subject to customer's risk profile. Refer to the table below to know the current personal loan rates. How much car can I afford? · Shop around to find the best rate · Lock in a rate by getting preapproved · Be prepared for signing · Begin making loan payments. TD Auto Finance offers financing for your new stage in life. Don't let previous negative credit slow you down on the road to a vehicle purchase. You may. In the first quarter of , the average new car rate was %. For used cars, the average was %. Improving your credit score isn't the only way to get a. Latest Auto Loan Rates from Banks and Credit Unions Across the Country & Compare Current Auto Loan Rates, Read Auto Loan Reviews & Save on Your Car Loan. It may be easier to secure a loan for a new car than it is for a used car, and new car loans often come with lower interest rates. Used cars can be a good. The three main factors in getting the best rate for an auto loan are your credit score, finances and the lender. Get expert advice on auto loans. Compare auto loan rates and discover how to save money on your next auto purchase or refinance. Shopping for a car? If you need a auto loan, find out how much you can borrow, and compare financing options. Calculating your payments is easy! The new car loan interest at IDFC FIRST Bank is subject to customer's risk profile. Refer to the table below to know the current personal loan rates. How much car can I afford? · Shop around to find the best rate · Lock in a rate by getting preapproved · Be prepared for signing · Begin making loan payments. TD Auto Finance offers financing for your new stage in life. Don't let previous negative credit slow you down on the road to a vehicle purchase. You may. In the first quarter of , the average new car rate was %. For used cars, the average was %. Improving your credit score isn't the only way to get a.

Additional info to know about your new car: ; 36 Months, @%, $, $13,, $1, ; 48 Months, @%, $, $13,, $1, Auto Loan ; , 66 months, % ; , 66 months, % ; , 60 months, % ; , 54 months, %. By way of example, for a new AUTO, with a purchase price of $20,, a 10% down payment equaling $2, and an annual percentage rate of % for 60 months. Citizens Bank's rate for a $15, auto loan beats the National average by up to 8% and is eligible for a Datatrac Great Rate Award and saving you as much as. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Although vehicle prices steadied through late and early , high interest rates on auto loans will linger for those with weak credit profiles, Bankrate. Rates are subject to change. These rates are available only for new and used car, truck and motorcycle loans. Your APR will be determined based on. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. According to print-service-dv.ru, Equifax, Edmunds, and Bankrate, a hard inquiry occurs when you apply for financing and the potential lender pulls your credit report. I'm just looking to compare auto loan rates, so I get on Bankrate and do a search. I felt like they treated me like a long time customer even though I was new. Get pre-qualify for a new auto loan in minutes. We can help with your new car financing with a fast and easy online experience. Apply today! What is a Check Ready Auto Loan? ; Secure Financing Before Visiting the Dealer, Yes, No ; Loan Amounts Available, $7, - $75,, $5, - $, ; %. Those with lower credit scores, from to , were % APR for new loans and % APR on used auto loans, which are significantly higher. It is. Get a lower auto loan refinancing rate. Save big by securing your auto loan before you head to the dealership. Loan rates as low as %! Car Loan interest rates are one of the key factors if you are considering taking a vehicle loan. Car Loans have gained immense popularity in India over the. Rates are subject to change. These rates are available only for new and used car, truck and motorcycle loans. Your APR will be determined based on. Payment Example: Auto Loan - For a $20, loan on a new auto with a month term, day first payment date, and % APR, the monthly payment will be. Auto Loans Interest Rates ; SBI Green Car Loan (For Electric Cars). From % to % ; Certified Pre-owned Car Loan Scheme. From % to % (CIC Based. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. What is a Check Ready Auto Loan? ; Secure Financing Before Visiting the Dealer, Yes, No ; Loan Amounts Available, $7, - $75,, $5, - $, ; %.

How Do I Set Up A Trust For My Property

There are two types of trusts you can establish: a revocable trust or an irrevocable trust. Revocable vs. Irrevocable Trust. Revocable Trust. You can change the. Documents · Living Trust. Plan the distribution of your property and assets · Living Trust Amendment. Change an existing Living Trust · Certification of Living. You must create the form stating precisely what you are transferring to the (named) trustee of the (named) trust. Sign and date the form. You must sign it once. If you hire an attorney to create the trust for you, the cost may include an initial consultation fee, drafting fees, and ongoing maintenance fees. Some. Learn about the benefits of a living trust, how a trust differs from a will, and the steps you'll need to take to set up a living trust in New York. To create a trust, the trust maker (usually called the settlor or grantor in the trust document) transfers legal ownership of his or her property to a person or. A trust is created when it is signed, or it can be created orally. It can be funded anytime. In a trust, assets are entrusted to a trustee who holds legal title. Depending on the purpose of your trust, you may wish to create a revocable living trust, an irrevocable trust, or a testamentary trust. A revocable living trust. Establishing a trust requires a document that specifies your wishes, lists beneficiaries, names a trustee or trustees to manage the assets, and describes what. There are two types of trusts you can establish: a revocable trust or an irrevocable trust. Revocable vs. Irrevocable Trust. Revocable Trust. You can change the. Documents · Living Trust. Plan the distribution of your property and assets · Living Trust Amendment. Change an existing Living Trust · Certification of Living. You must create the form stating precisely what you are transferring to the (named) trustee of the (named) trust. Sign and date the form. You must sign it once. If you hire an attorney to create the trust for you, the cost may include an initial consultation fee, drafting fees, and ongoing maintenance fees. Some. Learn about the benefits of a living trust, how a trust differs from a will, and the steps you'll need to take to set up a living trust in New York. To create a trust, the trust maker (usually called the settlor or grantor in the trust document) transfers legal ownership of his or her property to a person or. A trust is created when it is signed, or it can be created orally. It can be funded anytime. In a trust, assets are entrusted to a trustee who holds legal title. Depending on the purpose of your trust, you may wish to create a revocable living trust, an irrevocable trust, or a testamentary trust. A revocable living trust. Establishing a trust requires a document that specifies your wishes, lists beneficiaries, names a trustee or trustees to manage the assets, and describes what.

In other words, if you set up a Living Trust, you can be the settlor, the trustee and the beneficiary of the trust. You keep full control over the property and. ▻ What should I consider when creating a trust to hold my property after my death? · Decide who to name as a Trustee and successor Trustees. · Decide whether to. If you purchase a new home or other real property, you could purchase it in the name of the trust to avoid formal transactions and transfer fees. · If you open a. Transferring real estate to your Trust typically requires signing a deed to transfer your interest in the property to the Trust and then recording that deed. Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed. The drafting of your trust should be done by an attorney trained in the area of tax and trust law. It's important that you seek out a law firm with experience. The probate process can be time-consuming and expensive, so many people try to avoid it by setting up a trust. When a property is held in a trust, it does not. It should include the names of the trustor (the person creating the trust) and the beneficiaries (the person or people who will benefit from the trust). It. A trust is a legal document that sets up a grantor, sometimes called a settler, or something else. But you, you put your stuff into the trust, and you choose. To set up a living trust, you'll choose the type of trust you'll need, take a thorough inventory of your property, and choose a trustee. Then you'll need to. The names of the owner or owners of the home exactly as it appears on the current deed. · The APN or Assessor Parcel Number for the home. · The legal name of your. By putting a house into a trust, you can ensure that one of your most important assets will be managed and taken care of by someone you trust in the event you. Determining the type of trust you need. · Take inventory of your investments, assets, and property. · Select a trustee (the person who manages the trust). · Have a. When you create the living trust, you also name yourself the trustee. The trustee is the individual with authority to oversee all of the funds, assets, and. If you establish a trust but fail to transfer your assets to your trustee, it is unlikely that you will avoid probate. If you die owning real estate outside. A trust is a legal document used to establish a “container” that holds assets, like money or property. The trust's assets are then managed by you (aka, the. To create a trust, the trust maker (usually called the settlor or grantor in the trust document) transfers legal ownership of his or her property to a person or. A trust fund is the property transferred by the grantor to the trustee, known as the corpus of the trust Though the word "fund" suggests financial assets. To start, you name the Trust, name its Trustee, and name its Beneficiaries. You decide what property it will own, who will manage the Trust, and who will. First, a deed must be prepared transferring the ownership of the house from your name into the name of your trust. In addition, you may need to get other.

Does My American Express Card Cover Travel Insurance

Most or all cards have Trip Delay & Interruption coverage that reimburses for cancellations read the exclusions though. Most of the good third. Enjoy a Variety of Travel & Retail Benefits with American Express Cards. Select a Benefit to View the Eligible Cards and Benefit Terms & Conditions. Travel insurance coverage varies from Card to Card. Your American Express® Card may cover you with certain benefits related to travel, such as: Travel Emergency. As basic travel insurance does not include cover for pre-existing medical conditions and hazardous activities, you have the option to buy additional cover from. Free overseas travel insurance cover from Allianz Insurance Lanka Ltd Is available to you and your family when you purchase your return air tickets using your. We find that the descriptors of trip protection coverage can be very misleading. AMEX credit cards (and American Express Travel Insurance) refer to 'Travel. The Travel Insurance service from American Express US allows you to create and customise your own Travel Insurance coverage. Covered Trip to your Eligible Card. Evidence of For Trip Cancellation and Interruption Insurance, coverage does not apply to any Accident, Accidental. Trip Cancellation and Interruption Insurance is effective for round-trip purchases made entirely with your eligible Card and protects against Covered Losses . Most or all cards have Trip Delay & Interruption coverage that reimburses for cancellations read the exclusions though. Most of the good third. Enjoy a Variety of Travel & Retail Benefits with American Express Cards. Select a Benefit to View the Eligible Cards and Benefit Terms & Conditions. Travel insurance coverage varies from Card to Card. Your American Express® Card may cover you with certain benefits related to travel, such as: Travel Emergency. As basic travel insurance does not include cover for pre-existing medical conditions and hazardous activities, you have the option to buy additional cover from. Free overseas travel insurance cover from Allianz Insurance Lanka Ltd Is available to you and your family when you purchase your return air tickets using your. We find that the descriptors of trip protection coverage can be very misleading. AMEX credit cards (and American Express Travel Insurance) refer to 'Travel. The Travel Insurance service from American Express US allows you to create and customise your own Travel Insurance coverage. Covered Trip to your Eligible Card. Evidence of For Trip Cancellation and Interruption Insurance, coverage does not apply to any Accident, Accidental. Trip Cancellation and Interruption Insurance is effective for round-trip purchases made entirely with your eligible Card and protects against Covered Losses .

Coverage meets value. Insurance from American Express provides flexible coverage that can fit your budget. Flexible to suit your needs. To submit a claim for Travel Accident Insurance3†, please call (toll-free from the US & Canada). To submit a claim for Out of Province/Country. This product provides excess coverage and does not include liability coverage. Travel Accident Insurance You can use Membership Rewards® points to cover your. American Express includes secondary car rental coverage on many of its cards How does credit card travel insurance work? 3 credit card perks to make. Please refer to your Terms and Conditions for details of the insurance cover provided with your Card. For more information refer to the Insurance Portal. Covers non-refundable and non-transferrable unused portion of your prepaid travel arrangements for trip interruptions up to a maximum of $15, per person /. Out of Province/Country Emergency Medical Insurance1† (for under age 65) · Lost or Stolen Baggage Insurance · Baggage Delay Insurance · Trip Cancellation Insurance. With AMEX® Travel Insurance†, you and your family can be protected for unexpected emergency medical expenses while travelling, so you can feel good knowing you. Well insured – thanks to American Express credit cards · Travel Insurance · Purchase Protection Insurance · Loss Damage Waiver for Rental Cars · Insurance cover by. Make sure you're protected on your next trip with American Express travel insurance. See if your Amex card has you covered or if you need a separate policy. Depending on the Card you hold, some American Express Credit Cards provide complimentary Domestic and International Travel Insurance, when you use your Card to. Travel Accident Insurance offers a coverage of up to US$, in case of accidental death or dismemberment while traveling on a Common Carrier Conveyance . The AMEX travel insurance will cover trip cancellation, interruption and delays, travel medical, lost luggage, and provides worldwide travel assistance services. AMEX Credit Card Travel Insurance is embedded into some, but not all, of their cards. Different cards have different levels of cover. AMEX cards have highly. What does American Express Travel Insurance cover? · Trip cancellation & trip interruption insurance · Emergency medical expenses · Medical evacuation expenses. $, Travel Accident Insurance · Purchase Protection® Plan · Buyer's Assurance® Protection Plan · Legal. Watch out with the Amex Travel Insurance: some aspects are only covered if you have actually paid for the travel using the Amex card. If you use. If you pay for travel using your card and a covered incident impacts your trip, you may be reimbursed for all or a portion of related expenses. What does credit. All Amex cards with this benefit provide the same level of protection. If your trip is canceled or interrupted for a covered reason, you can receive a maximum. As a Platinum Cardholder, you and your immediate family are covered by Amex Platinum Travel Insurance from the moment you book with your Card. Learn more.

Can You Put A Bowl In The Oven

Oven Safe Bowls(19) · Pyrex Simply Store 4 Cup Glass Bowl Value Pack, Set of 2 · Hengtai Microwave Bowl Cozy Safe Hot Bowl Holder Heat Resistant Bowl Cozies For. Deep oven dish in clear glass that you can take directly from the oven and put on the table. Two small handles make it easy to lift and carry – with. Most glass and ceramic bowls are oven safe, other than the ones that have decorations painted or screen printed on them. They will be safe in. If your glass mug or dish has survived in the microwave or oven before, it likely won't break in the air fryer. Even still, we recommend holding your dish up to. The appliance and its included accessories are not dishwasher safe! Make sure you give everything a chance to cool before handling any of the components for. The glass dish It is one of the most popular materials in the kitchen. But be careful, not all glass dishes withstand heat in the same way since only those. It should be noted that a ceramic bowl or other container that is not specially enameled to withstand high temperatures will not be the most suitable for. Convection Only mode is the only mode that all oven safe cookware can be used in. All other modes are a Microwave/Convection mix or Microwave only. In Microwave. 1. The heat -resistant glass bowl can not only be put in the oven for use, but also can be used for microwave heating, hot water disinfection equipment, and can. Oven Safe Bowls(19) · Pyrex Simply Store 4 Cup Glass Bowl Value Pack, Set of 2 · Hengtai Microwave Bowl Cozy Safe Hot Bowl Holder Heat Resistant Bowl Cozies For. Deep oven dish in clear glass that you can take directly from the oven and put on the table. Two small handles make it easy to lift and carry – with. Most glass and ceramic bowls are oven safe, other than the ones that have decorations painted or screen printed on them. They will be safe in. If your glass mug or dish has survived in the microwave or oven before, it likely won't break in the air fryer. Even still, we recommend holding your dish up to. The appliance and its included accessories are not dishwasher safe! Make sure you give everything a chance to cool before handling any of the components for. The glass dish It is one of the most popular materials in the kitchen. But be careful, not all glass dishes withstand heat in the same way since only those. It should be noted that a ceramic bowl or other container that is not specially enameled to withstand high temperatures will not be the most suitable for. Convection Only mode is the only mode that all oven safe cookware can be used in. All other modes are a Microwave/Convection mix or Microwave only. In Microwave. 1. The heat -resistant glass bowl can not only be put in the oven for use, but also can be used for microwave heating, hot water disinfection equipment, and can.

If you're looking to create more steam in the baking process, sealing the dish tightly with a foil lid will often do the trick. Foil baking pan icon. Use. From oven to tabletop, our range of oven and bakeware are perfect for roasting, baking, cooking and serving food. Choose from fine quality glassware or. Shop Target for stoneware bowls oven safe you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on. The outer beauty of these bowls doesn't put a damper on their utility; they are safe for use in the freezer, microwave or up to ℉ in the oven. Their. Ceramic bowls are microwave, oven, freezer, and dishwasher-safe. Stainless steel bowls are dishwasher-safe and, like all metals, are not microwave-safe. Related. Uncoated cookware is oven-proof to °F / °C. It can be used in all types of conventional ovens, and fry pans may be used under the broiler. To protect. When it comes to glass or ceramic plates, bowls, cups, mugs, mixing bowls or bakeware, you should be in the clear as long as it doesn't feature metallic paint. No, oven safe stoneware bowls are not suitable for use on the stovetop. They are designed for oven use only and may crack or break if placed directly on a. All Crock-Pot® Slow Cooker removable crockery inserts (without lid) may be used safely in the microwave and the oven set up to °F. If you own another slow. This means that you can put them from your freezer directly into the microwave and vice-versa, without worrying about them. Looks Good. Does Good While the bowl. Kook French Onion Soup Crocks, Stackable Ceramic Bowls with Handles, Oven, Microwave and. More Like This. Resistant to thermal shock and extreme temperatures up to °C, our glass can go from freezer to oven without any worry. In addition, borosilicate glass. But, that said, you can use any heat-proof, oven-safe dish, and aluminum Do not put the following in the Wonder Oven to cook: parchment paper. Therefore, do not take dinnerware from the freezer and place it directly into a microwave/hot oven, or take hot dinnerware from the oven/microwave and place it. I asked for one of each of these bowls for Christmas and got both since receiving them, I've tried to use them for every possible reason I can while hosting. Shop Target for oven safe bowl you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on orders $35+. Yes. Your Fiesta® is fully oven/microwave/dishwasher/and freezer safe. Our products are made to accommodate the food service/hotel industry professional. Since the oven floor is usually covered in all sorts of mess, it's a good idea to line the base with either a piece of tin foil or specially-designed oven. Do not allow dish to come into contact with interior sides of oven or microwave which could cause localized overheating of dish or handle. Follow all. Shop Pottery Barn for expertly crafted oven safe bowls. Find oven safe You can change where you would like to ship your items in the top right.

Uptoken

What is UpToken (UP)?. UpToken is the native cryptocurrency of Coinme, a company that provides financial services and products, including an ATM network. Get the latest on UpToken (UP) and trade today! Bitbuy provides current CAD & USD prices, news, trends, charts & more. Ready to start trading UpToken? Uptoken helps enable crypto companies at any stage to easily incentivize their employees & ecosystems without fearing scammers or regulators. Another option to buy the UpToken is through a decentralized exchange (DEX) which supports the blockchain where your UpToken resides. This guide will show you. print-service-dv.ru Joined April 67 Following · Followers · Posts has a brilliant realization about how the Up Token vaults will be forever. Track current UpToken prices in real-time with historical UP USD charts, liquidity, and volume. Get top exchanges, markets, and more. Honoring #peaceday today at the UpToken office. "Together for Peace: Respect, Safety and Dignity for All.". r/UpToken: Discussion related to the token sale and ongoing usage of UpToken. The price of uP Token (UP) is $ today with a hour trading volume of $5, This represents a % price increase in the last What is UpToken (UP)?. UpToken is the native cryptocurrency of Coinme, a company that provides financial services and products, including an ATM network. Get the latest on UpToken (UP) and trade today! Bitbuy provides current CAD & USD prices, news, trends, charts & more. Ready to start trading UpToken? Uptoken helps enable crypto companies at any stage to easily incentivize their employees & ecosystems without fearing scammers or regulators. Another option to buy the UpToken is through a decentralized exchange (DEX) which supports the blockchain where your UpToken resides. This guide will show you. print-service-dv.ru Joined April 67 Following · Followers · Posts has a brilliant realization about how the Up Token vaults will be forever. Track current UpToken prices in real-time with historical UP USD charts, liquidity, and volume. Get top exchanges, markets, and more. Honoring #peaceday today at the UpToken office. "Together for Peace: Respect, Safety and Dignity for All.". r/UpToken: Discussion related to the token sale and ongoing usage of UpToken. The price of uP Token (UP) is $ today with a hour trading volume of $5, This represents a % price increase in the last

UpToken USD Overview. UpToken (UP) is a cryptocurrency and operates on the Ethereum platform. UpToken has a current supply of ,, with 0 in circulation. UpToken is a reward for our ATM customers. Coinme uses 1% of every ATM transaction to purchase UpToken, which is given to customers as a 1% “cash back”. Alto Palo team worked with UpToken, a cryptocurrency platform. Our expert team had delivered UI UX design, mobile design, WordPress development solutions. Get the latest and historical UpToken price, UP market cap, trading pairs, and exchanges. Check the charts, UP to USD calculator, and more on Coinpaprika. UpToken is on the rise this week. The price of UpToken has increased by % in the last hour and increased by % in the past 24 hours. UpToken's price. CryptoCompare Index UpToken (UP) - BTC Historical Price. CryptoCompare Index UpToken (UP) - BTC. Line Chart. Logarithmic. Candle Stick. Advanced Chart. 1 Hour 1. The current market price today of UpToken is USD and is + over the last 24 hours, and + over the last 7 days. It is currently traded with 7. UpToken have raised a total of $ M in 1 completed rounds: ICO At the moment Market Cap is $, UP Token Price is $ The price of UpToken (UP) is?, market capitalization is? with the circulating supply of? UP. Since yesterday this crypto showed the change in the price. Overall, UpToken is an interesting project that offers a range of services for individuals and businesses who are interested in cryptocurrency. Its focus on. Among the plethora of cryptocurrencies, UpToken stands out as a unique and empowering digital currency that aims to redefine the concept of financial inclusion. What can I use UpToken for? UpToken is a reward for our ATM customers. Coinme uses 1% of every ATM transaction to purchase UpToken, which is given to. Easily convert UpToken to US Dollar with our cryptocurrency converter. 1 UP is currently worth $NaN. Stay updated with the latest uptoken token price, charts, and market trends. Dive deep into comprehensive cryptocurrency news and insights on our platform. uP Token sacrifice ended 9/22/22, airdropped on 1/30/23, available on PLS since 5/12/ How Much Did UpToken Raise? The UpToken ICO (initial coin offering) raised $18,, USD by selling UpToken tokens at a price of $ USD. The. UpToken is the token asset of CoinME, a crypto ATM manufacturer and service provider. UpToken additional differentiation against competition. Holders of the. Get the live UpToken price today is $ USD. UP to USD price chart, predication, trading pairs, market cap & latest UpToken news. UpToken is a project which aims to establish “a crypto ATM on every corner”. Developers Coinme are the company behind the scheme, which has a native UP token. UpToken. likes. Coinme, a venture-backed crypto financial services and blockchain technology company, announced UpTo.

Business Budget Planning

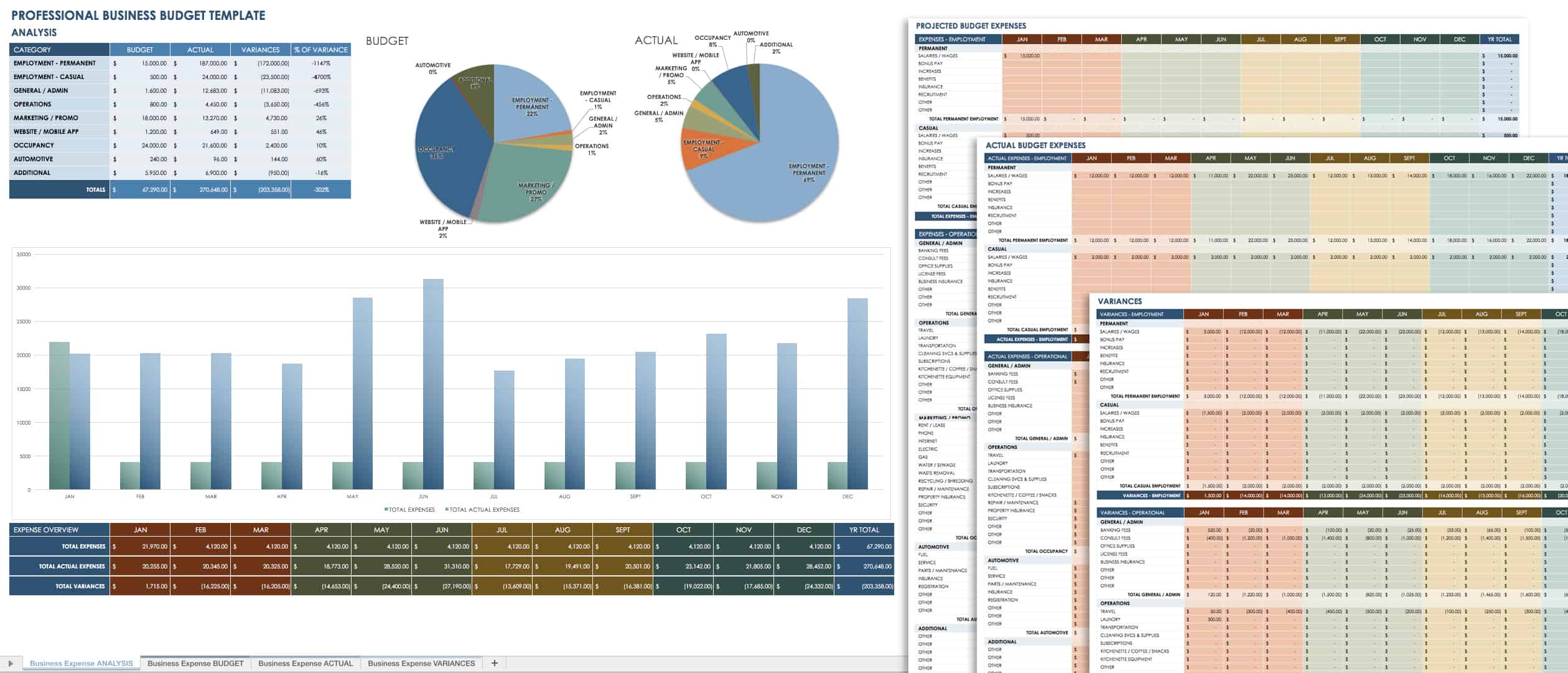

A startup budget is a simple breakdown of how you plan to use your capital and cover expected business costs. Whether you're pre-revenue or a later-stage tech. Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization's short and long-term financial goals. Benefits of a business budget · manage your money effectively · allocate appropriate resources to projects · monitor performance · meet your objectives. Should a company revise its annual budget during the course of the fiscal year as conditions change? Revised budgets are more accurate, since they embody the. How to Create a Budget for a Business · 1. Write down your revenue streams. · 2. Write down the cost of goods sold (if you have them). · 3. List your expense. Spend smarter with a guided budgeting tool · Creating an accurate budget is tricky without any guidance · LivePlan walks you through the entire budgeting process. Although the budgeting process for companies can become complex, at its most basic, a budget compares a company's revenue with its expenses in a given period. A business budget is a financial plan that outlines the expected income and expenses of a company over a specific period, usually a year. Business budgets also communicate company priorities to staff, allocating funds to the most important parts of the business plan. Comparing actual spending to. A startup budget is a simple breakdown of how you plan to use your capital and cover expected business costs. Whether you're pre-revenue or a later-stage tech. Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization's short and long-term financial goals. Benefits of a business budget · manage your money effectively · allocate appropriate resources to projects · monitor performance · meet your objectives. Should a company revise its annual budget during the course of the fiscal year as conditions change? Revised budgets are more accurate, since they embody the. How to Create a Budget for a Business · 1. Write down your revenue streams. · 2. Write down the cost of goods sold (if you have them). · 3. List your expense. Spend smarter with a guided budgeting tool · Creating an accurate budget is tricky without any guidance · LivePlan walks you through the entire budgeting process. Although the budgeting process for companies can become complex, at its most basic, a budget compares a company's revenue with its expenses in a given period. A business budget is a financial plan that outlines the expected income and expenses of a company over a specific period, usually a year. Business budgets also communicate company priorities to staff, allocating funds to the most important parts of the business plan. Comparing actual spending to.

The right accounting tools make it easy to create different types of small business budgets. FreshBooks accounting software helps you track and categorize. 8 Things to Consider When Planning an Annual Budget for your Business · Some costs relate directly to revenue, whether they be inventory or employee services. predict revenue. A business budget should include: Estimated revenue; Fixed costs; Variable costs; One-off costs; Cash flow; Profit; A budget calculator. 6 Steps to a Better Business Budget · 1. Check Industry Standards · 2. Make a Spreadsheet · 3. Factor in Some Slack · 4. Look to Cut Costs · 5. Review the Business. 10 ways to create budget for new fiscal year · Examine costs · Estimate your revenue · Contingency plan · Analyze capital expenditure · Evaluate cash flow. You can easily edit these free business budget templates in Excel. Change the fonts, colors, and more, or add your business logo for a professional look. You. The budget should also have two columns next to each category and subcategory. One is for projections. The second is for actual results. This allows you to. How to create a business budget template. · Add up revenue in a business budget worksheet. · List your fixed costs. · Calculate inconsistent business expenses. Again, a business budget is a key piece of your business plan (which you'll learn about more in the next course). It helps you determine how much money you need. Five stages of budget management · 1. Financial analysis. Budget planners must have keen analytical skills to ensure projections are accurate and goals. Actuals – comparing actual results to budgeted amounts. Record your business's actual income and expenses during the budget period. Calculate the difference. The budget should be in place before the start of the financial year. Your business plan should help in establishing projected sales, cost of sales, fixed costs. You can create a budget quickly. You just need to follow tested steps so you can secure your bank account and improve your business's chances of success. By using the business budget, the firms will make the business decisions, whether to improve the business in some of the ways, expense adjustments, focus on. Key steps to follow when creating business budget · 1. Research & categorize costs · 2. Focus on projecting revenue · 3. Improve gross margin profit · 4. Plan a. Business Budget Template This detailed, all-in-one budgeting template is a perfect fit for small business owners who want to keep tabs on the financial health. Your small business budget plan will include your projected income and expenses, which in-turn helps you to make decisions about where your money will be best. How to create an effective business budget · Fixed expenses/overheads. These are regular, fixed monthly costs not tied to your business's success. · Variable. Budgeting is the tactical implementation of a business plan. To achieve the goals in a business's strategic plan, we need a detailed descriptive roadmap. Creating the Budget · Step 1 Get a template online.

Exchange Traded Funds Meaning

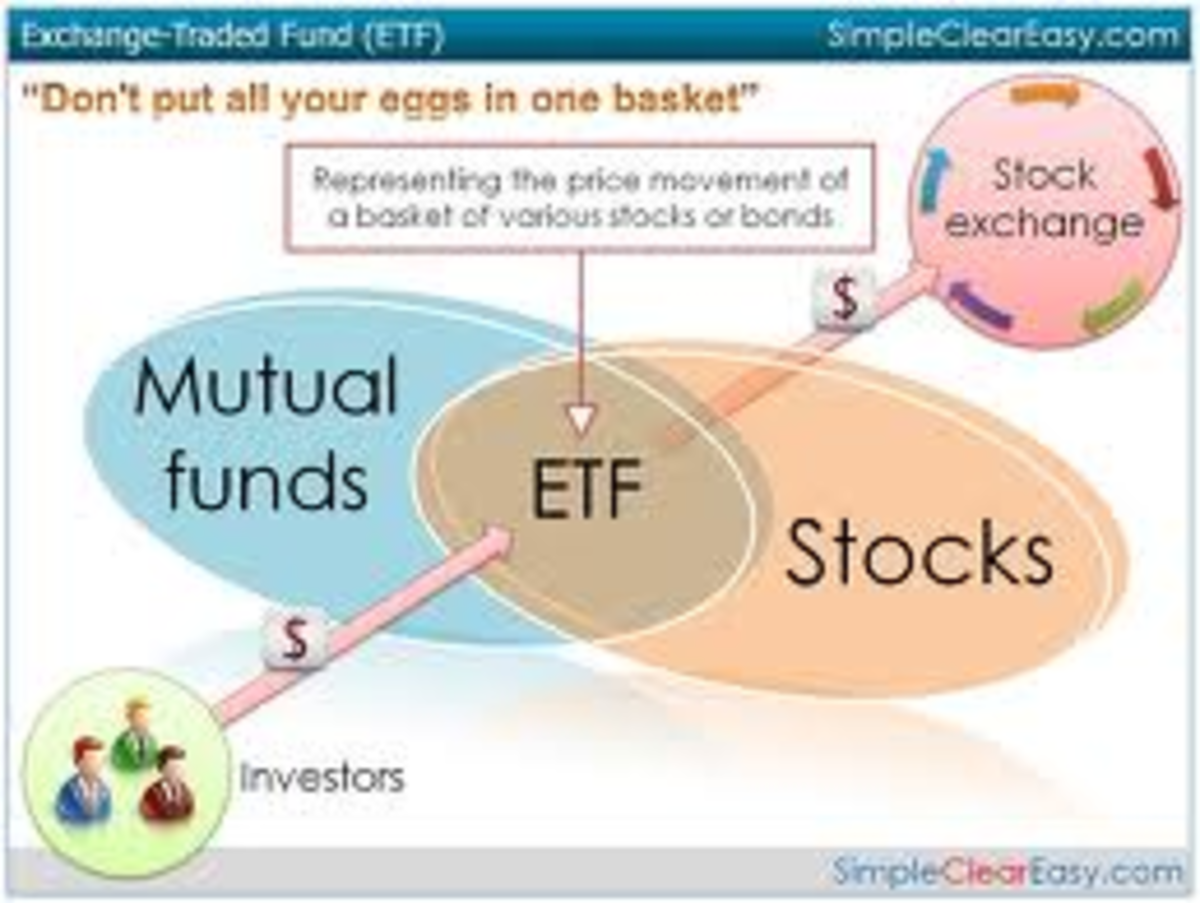

An ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. Growth in ETFs has also been driven by the increased use of index-based investing. ETF investors need to understand how these products work and trade and how to. Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds, or. ETFs combine the easy trading of stocks with the diversification of mutual funds. Most ETFs passively track indexes, offering lower fees and predictable. What exactly is an ETF (Exchange Traded Fund) and how does it work? In this video, we explain the ins and outs of ETFs and define some key terms. What is an ETF? (exchange-traded fund) Exchange-traded funds (ETFs) are a popular type of collective investment that provide access to a wide range of markets. Exchange-traded funds (ETFs) and other exchange-traded products (ETPs) combine aspects of mutual funds and conventional stocks. As with any investment. An Exchange-Traded Fund (ETF) is an investment fund that holds assets such as stocks, commodities, bonds, or foreign currency. An ETF is traded like a stock. Exchange traded funds (ETFs) are a type of security that combines the flexibility of stocks with the diversification of mutual funds. The exchange traded. An ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. Growth in ETFs has also been driven by the increased use of index-based investing. ETF investors need to understand how these products work and trade and how to. Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds, or. ETFs combine the easy trading of stocks with the diversification of mutual funds. Most ETFs passively track indexes, offering lower fees and predictable. What exactly is an ETF (Exchange Traded Fund) and how does it work? In this video, we explain the ins and outs of ETFs and define some key terms. What is an ETF? (exchange-traded fund) Exchange-traded funds (ETFs) are a popular type of collective investment that provide access to a wide range of markets. Exchange-traded funds (ETFs) and other exchange-traded products (ETPs) combine aspects of mutual funds and conventional stocks. As with any investment. An Exchange-Traded Fund (ETF) is an investment fund that holds assets such as stocks, commodities, bonds, or foreign currency. An ETF is traded like a stock. Exchange traded funds (ETFs) are a type of security that combines the flexibility of stocks with the diversification of mutual funds. The exchange traded.

An exchange-traded fund (ETF) is a collection of investments such as equities or bonds. ETFs will let you invest in a large number of securities at once, and. ETFs offer investors a way to combine their money and invest as a group in a basket of securities. · ETF shares are bought and sold throughout the day on an. An ETF is an exchange-traded fund, which means it is a fund that tracks the price of underlying securities, equity, debt, stocks, or commodities within it. They combine features and potential benefits similar to those of stocks, mutual funds, or bonds. Like individual stocks, ETF shares are traded throughout the. ETFs An exchange-traded fund (ETF) is a basket of securities you buy or sell through a brokerage firm on a stock exchange. ETF stands for Exchange Traded Funds. ETFs attempt to track the performance of a specific index - such as the S&P - as closely as possible. Learn more. Exchange-traded funds (ETFs) are a simple, low-cost way to invest in financial markets. They can be held in RRSPs, non-registered accounts and more. An exchange-traded fund (ETF) is a basket of securities that tracks or seeks to outperform an underlying index. ETFs can contain investments such as stocks and. An exchange-traded fund (ETF) is a UCITS fund that tracks an index like the FTSE or EURO STOXX 50 and trades like a share. An ETF combines the benefits of a. What Is an ETF? An exchange-traded fund, or ETF, is a bundle of securities that investors can buy or sell on a stock exchange. An ETF can include anywhere from. Exchange-traded-funds, or ETFs, are similar to mutual funds in that they invest in a basket of securities, such as stocks, bonds, or other asset classes. ETFs (exchange-traded funds) and mutual funds both offer exposure to a wide variety of asset classes and niche markets. They generally provide more. In return, the Authorized. Participant receives a pre-defined basket of individual securities, or the cash equivalent. Other investors purchase and sell ETF. Exchange-traded funds (ETFs) are ready-made collections of stocks, bonds, and other assets that trade throughout the day on an exchange. ETFs may be tied to. You can buy and sell units in ETFs through a stockbroker, the same way you buy and sell shares. How ETFs work. An ETF is a managed fund. An exchange-traded fund (ETF) tracks multiple stocks or other securities to let you invest in a sector, industry, or even region—Through an ETF, you could also. Equity ETFs are described as passive investment options combining the features of stocks and equity mutual funds. Investors can trade these funds on stock. Unlike many mutual funds, ETFs are usually managed passively — meaning there is no human fund-manager hunched over a Bloomberg terminal deciding which stocks to. The biggest similarity between ETFs (exchange-traded funds) and mutual funds is that they both represent professionally managed collections (or "baskets"). Exchange-traded-funds, or ETFs, are like managed funds in that they invest in a basket of securities, such as stocks, bonds, or other asset classes.